Equity Insights

In a nutshell

- Al-driven sectors contributed approximately 60 per cent of S&P 500 earnings growth in 2025, with semiconductor and cloud infrastructure providers leading due to physical infrastructure investment

- While parallels to past speculative bubbles exist, the Al cycle differs with its foundation in tangible infrastructure, such as compute power, data centres, and semiconductors

- Near-term earnings visibility is concentrated upstream in hardware due to supply constraints, but risks persist if downstream monetisation expectations fail to materialise at scale

- Equity valuations reflect forward-looking confidence in Al monetisation, but uneven enterprise adoption and speculative private market valuations could introduce valuation risks. Any delay in downstream adoption could lead to valuation corrections.

- Emerging markets, particularly China, are leveraging cost efficiencies, scale, and integrated ecosystems to monetise Al applications rapidly, challenging traditional leadership in Al value capture

- A barbell investment strategy balancing infrastructure-led earnings reliability with speculative but high-growth software opportunities can mitigate risks while positioning for structural Al-driven growth

Path to monetisation in Al cycle

Current cycle may have similarities to a bubble, but this phase of Al development is being driven by physical bottlenecks rather than user adoption curves."

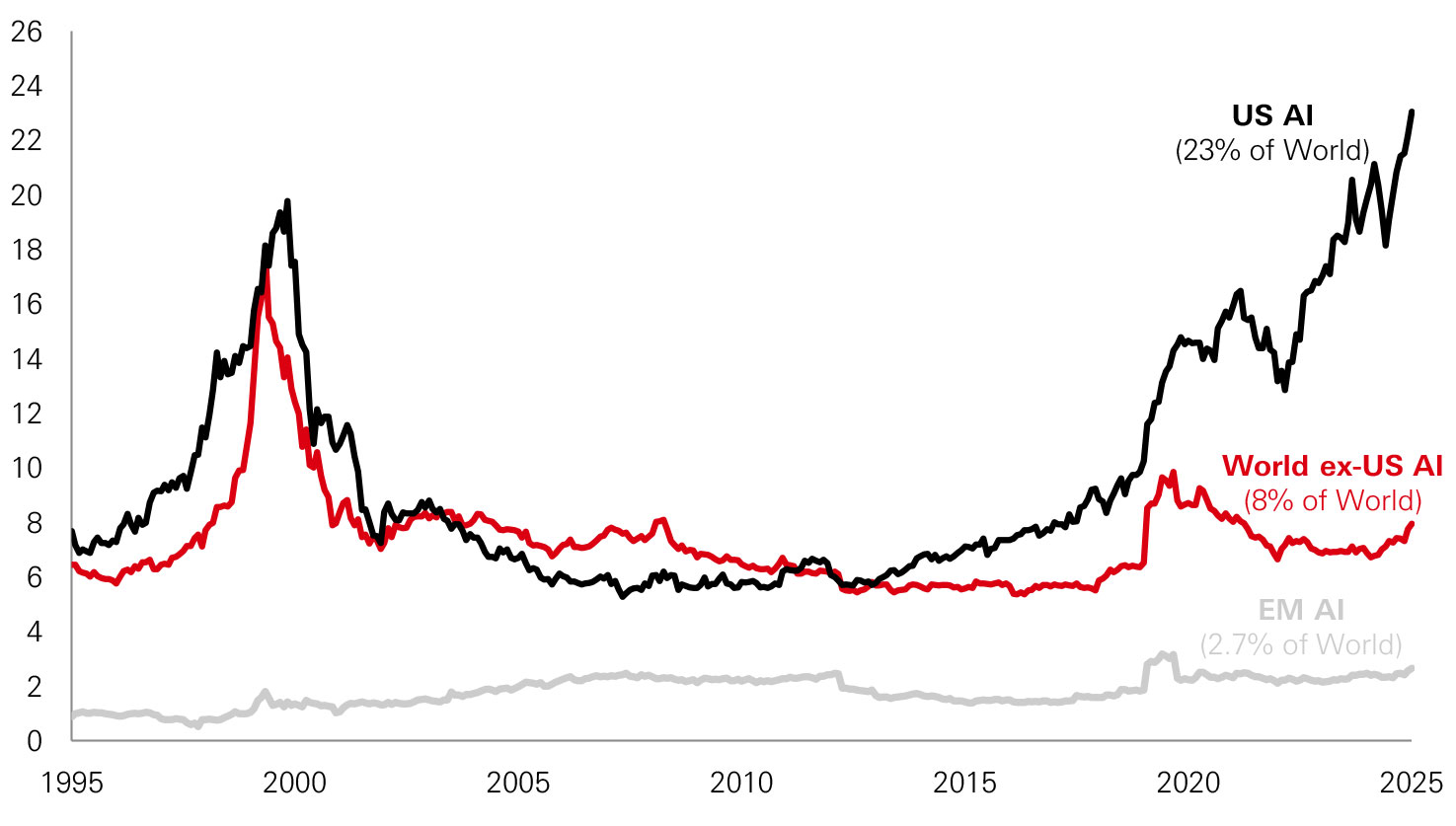

Global equity markets remain near record highs, yet performance is increasingly concentrated in a narrow segment of US mega-caps, which now account for roughly a quarter of global equity market capitalisation. Semiconductor manufacturers and cloud infrastructure providers have delivered repeated earnings upgrades, reinforcing the perception that AI is a durable multi-year investment cycle, rather than a short-lived thematic rally. In 2025, Al-related sectors alone accounted for approximately 60 per cent of S&P 500 earnings growth. Forecast revisions for leading chip companies continue to rise, with several large semiconductor firms now guiding to mid-teens to high-20s EPS growth for 2025–27. At the same time, segments further downstream in the value chain exhibit far weaker visibility and softer expectations.

Naturally, this divergence invites the familiar question of whether markets are witnessing a sustainable structural shift or the formation of a speculative bubble reminiscent of the early 2000s.

Figure 1: Technology and communication services sector weight share in global equities (%)

Click the image to enlarge

Source: HSBC AM, Refinitiv, Datastream. Data as of November 2025.

Is this cycle a bubble?

There are legitimate reasons for drawing parallels with past excesses. Valuations in parts of the AI ecosystem are elevated, capital intensity is rising rapidly, and markets are making long-dated assumptions about eventual monetisation that remain unproven. In particular, private markets show clear signs of stretched valuations, with venture-backed AI application companies commanding revenue multiples that far exceed public-market norms, often based on limited operating history and highly concentrated use cases. This mirrors earlier cycles, where in some cases, enthusiasm for transformative technology pulled forward years of expected value creation.

At the same time, today's cycle differs in that unprecedented levels of capital are being committed upfront to physical infrastructure. Hyperscalers, semiconductor manufacturers and network providers are deploying capital at scale, driven by rising compute usage, model complexity and time-on-task metrics. This does not eliminate speculative behaviour, but it does anchor the cycle in tangible investment rather than purely conceptual demand.

In other words, the foundations are physical, but valuations remain forward-looking. The cycle is neither purely speculative nor immune to speculative risk — it contains elements of both, and its ultimate outcome depends on whether downstream monetisation required to justify that deployment ultimately materialises.

Physical build-out and infrastructure-led momentum

It is clear that the current phase is characterised by intense demand for compute infrastructure rather than confirmed end-user monetisation. The infrastructure required to train and run foundation models is intensive in power, land, specialised cooling, high-performance silicon and grid connectivity. Hyperscalers have not waited for monetisation visibility before spending. They are expanding aggressively, securing transformer allocations, substation access and land zoning rights alongside long-term power agreements, reflecting confidence in future usage rather than realised application revenues.

Concurrently, semiconductor fabrication investment is rising at a pace rarely seen outside mobile and broadband infrastructure cycles, with equipment supply chains operating at capacity. The binding constraint today is not willingness to deploy capital, but the availability of power infrastructure, high-bandwidth memory, transformers, advanced packaging capacity, and the space to house all these.

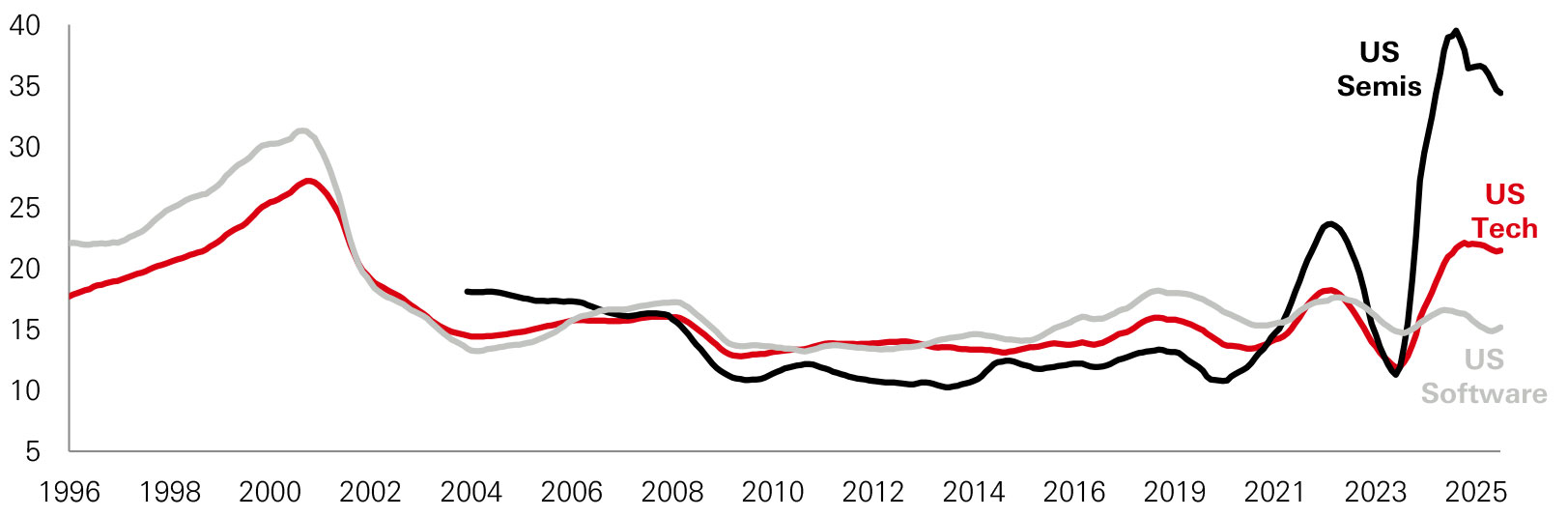

Figure 2: Annual medium-term EPS growth expectations (%)

Click the image to enlarge

Source: Refinitiv, IBES, Datastream, HSBC Asset Management, November 2025.

Importantly, recent earnings upgrades for semiconductors reflect these physical constraints. Several major chipmakers have reported order backlogs extending well into 2026, with high-bandwidth memory demand exceeding prior-cycle peaks and contributing meaningfully to forward EPS revisions. This does not imply certainty of end-user monetisation, but it does indicate utilisation-led scarcity at the infrastructure layer.

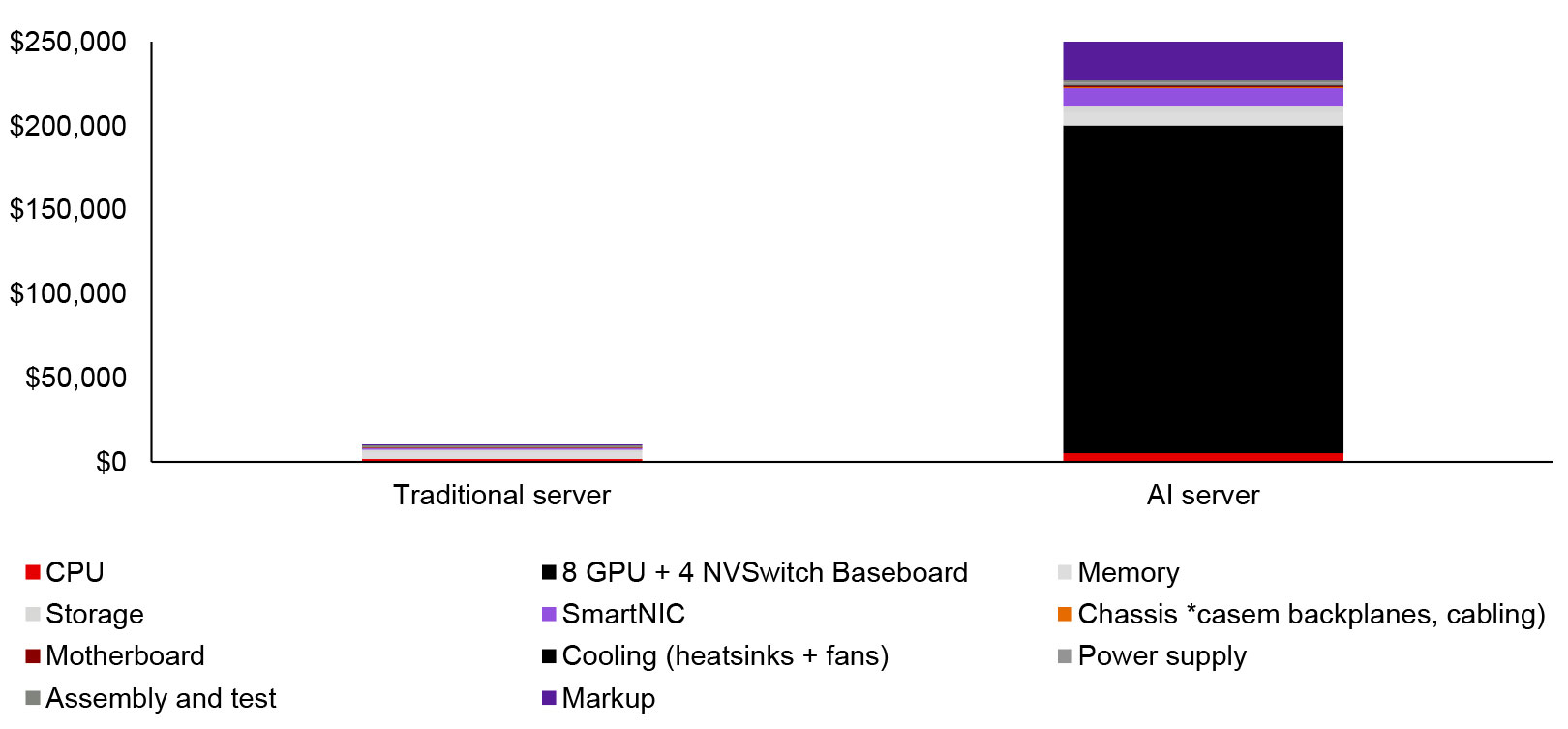

Compute cost inflation further illustrates this dynamic. A single rack of compute that cost roughly USD20,000 a decade ago now exceeds USD250,000, driven both by demand intensity and component scarcity.1 Nvidia’s margins reflect this duality. Its pricing power stems from constrained fabrication and packaging capacity rather than pure sentiment.

Figure 3: AI datacenter economics1

Click the image to enlarge

Source: HSBC AM, November 2025.

Similarly, AI build-outs across the US, Europe and Asia are reshaping power markets, accelerating transmission upgrades and aligning multi-year capital plans for utilities and industrial producers. While infrastructure being built today supports near-term earnings visibility upstream, it does not eliminate risk should downstream adoption fall short.

The first beneficiaries of AI have therefore been hardware-centric names, consistent with prior compute cycles in which silicon and infrastructure monetise before software. However, infrastructure revenues remain robust only so long as deployment plans hold. Should downstream monetisation disappoint materially, hyperscalers may defer, resize or redesign build-outs, introducing cancellation risk even at the hardware level.

1 - Dylan Patel and GeraldWong, ‘AI Server Cost Analysis – Memory is the biggest loser’,May 2023.

The invisible variable in equity pricing

Today, equity valuations embed significant confidence that downstream profit pools will ultimately materialise. Yet enterprise AI adoption remains uneven. Budget cycles are slow, many organisations remain in proof-of-concept stages, and large scale workflow integration is still developing. Productivity capture, licensing structures and usage based pricing models are evolving, with timelines varying widely by sector. Given application-layer revenues remain largely conceptual, markets are extrapolating long term outcomes rather than pricing established earnings streams.

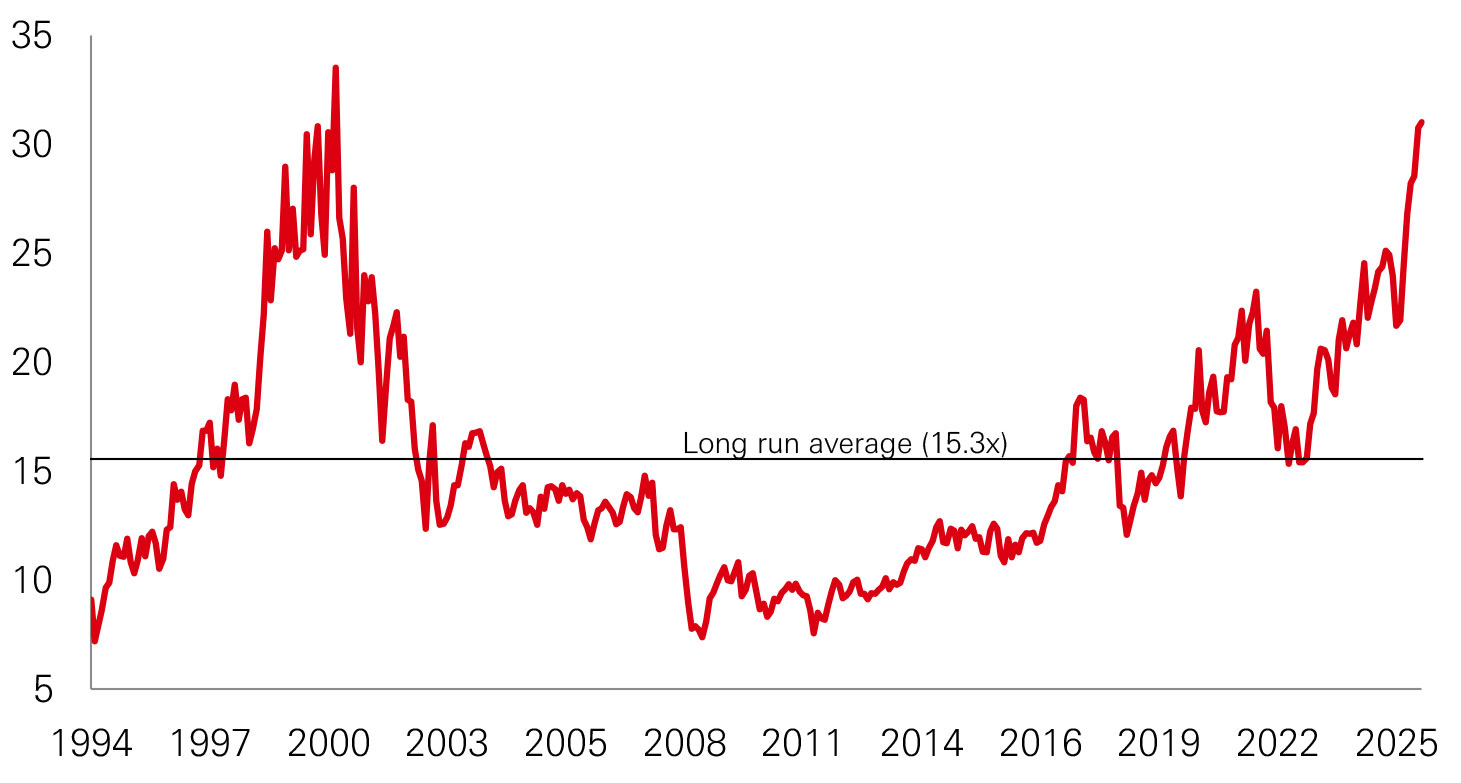

Figure 4: Price to cash earnings per share (x)

Click the image to enlarge

Source: HSBC AM, Refinitiv, Datastream. Data as of November.

This makes valuation risk worth examining carefully. Price to cash earnings per share for US mega-caps are approaching levels last seen during the late-1990s cycle. While earnings quality remains strong, reported figures benefit from capitalisation choices, depreciation assumptions and non-recurring add-backs. These practices are common in fast-growing sectors, but they increase sensitivity to any delay in monetisation. Private markets appear even more stretched, with AI-focused venture investments commanding aggressive revenue multiples despite limited operating histories, amplifying the risk of valuation correction if adoption disappoints.

End user demand therefore remains a critical uncertainty. Enterprises may not scale AI usage at the pace implied by current investment plans, particularly if IT budgets tighten, or productivity gains prove slower to realise. If adoption curves flatten or elongate, revenue realisation may lag capex, and margin expectations embedded in equity pricing, especially for software and consumer-facing platforms, could reset lower.

Hence, the current phase can be characterised as infrastructure-led, with monetisation expected to follow rather than already visible. The uncertainty lies less in whether applications emerge, and more in the timing and breadth of adoption required to justify today’s capital intensity. This asymmetry explains why earnings risk is skewed toward downstream software and platform businesses, while upstream suppliers retain greater near-term visibility — albeit still exposed if adoption assumptions are ultimately revised.

Global multipliers

Even if broader monetisation timelines remain difficult to forecast, rather than dismissing the cycle, it is important to recognise that the first phase of returns has accrued where supply cannot respond quickly.

First, opportunity lies in power infrastructure. Data-centre demand is now consuming grid allocations faster than residential construction in several US states. Transmission and transformer shortages extend build-out timelines by years, creating suppliers’ pricing power. This has positioned Korean and European high-voltage manufacturers, alongside select US grid equipment providers, to capture structurally constrained demand.

Another overlooked area is advanced packaging and server design. Taiwan dominates advanced packaging, while three firms alone, concentrated in Taiwan and China, control more than 90 per cent of global server manufacturing. These companies are not beneficiaries of AI hype — they are indispensable enablers of the AI value chain.

Commodities underpinning AI infrastructure expand the investment universe further. The compute and power intensity of AI increases demand for copper, silicon, rare earths, and platinum, much of which is extracted or refined in Chile, South Africa, Indonesia and China. Their importance rises as compute and energy intensity scales.

Broader emerging markets exemplify why looking beyond US mega-caps for the next wave can be beneficial. China, for example, is frequently underestimated in its AI potential, largely due to the perception that its capabilities are constrained by a lag in cutting-edge chip development and capex spending. However, China’s competitive playbook has never relied on technological first-mover advantage.

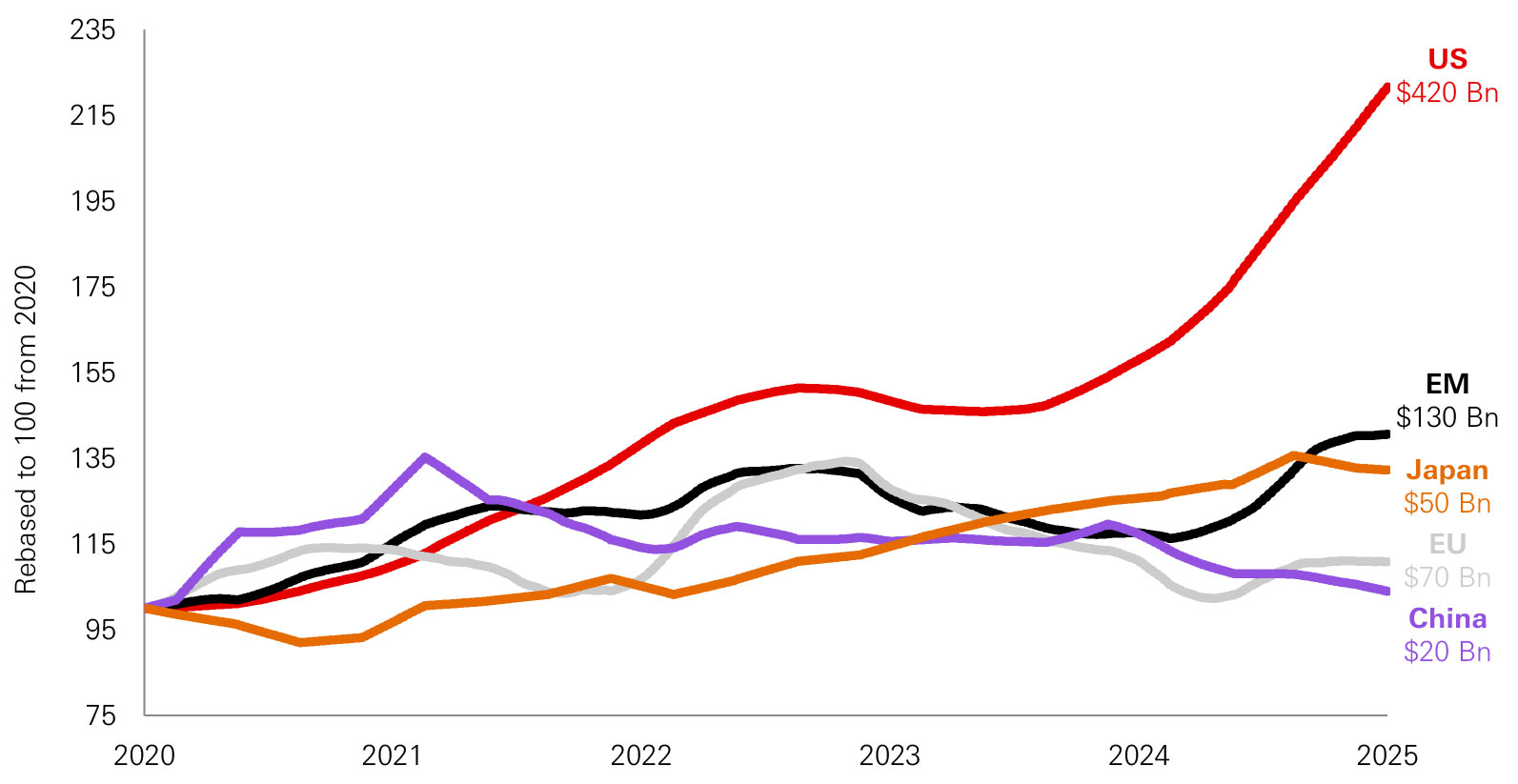

Figure 5: Regional capital expenditure in technology and communications sector (USD bn)

Click the image to enlarge

Source: HSBC AM, Refinitiv, Datastream. Data as of November 2025.

Instead, it competes through scale, cost disruption, state-backed industrial learning, and deep integration of AI into real-economy applications. This is critical in AI value capture which does not depend exclusively on building the most advanced model but relies on deploying models at scale across transaction-heavy ecosystems where monetisation is repeatable.

China operates closed loop data ecosystems tied directly to transactions in which payments, logistics, identity, retail, entertainment, and enterprise services sit within unified platforms. Alibaba, Meituan, Tencent and ByteDance collectively control an end-to-end chain of consumer interaction across transactions, data, and service delivery. In contrast, US platforms manage data fragmented across advertising, productivity tools, and software services. This allows China to monetise per user at a level that exceeds Western platforms even with smaller models.

Cost structure reinforces this advantage. China’s large language models are already priced at a fraction of their US and European peers, while offering increasingly competitive performance. For example, Baidu’s autonomous operations undercut Western competitors by as much as 80 per cent in unit economics, accelerating commercialisation timelines.

This mirrors past disruptions in solar, batteries, and EVs, where China closed capability gaps and reshaped global pricing. If AI follows a similar path, with adoption and cost outpacing innovation, China could define the economics of deployment even while trailing the US in frontier chips.

Chip restrictions are a constraint, but not a deadlock. China’s policy mandating local chips for AI infrastructure supports domestic semiconductor growth, backed by its expanding cloud market, which could reach USD1 trillion. This scale can foster a self-sufficient ecosystem to bridge cost and capability gaps.

Similarly, other markets are also leapfrog adopters rather than laggards. India and Gulf economies, for instance, are adopting AI without legacy system constraints and are deploying generative models directly into public administration, logistics, credit underwriting and education. This underscores that these markets are capable of absorbing AI faster once infrastructure is accessible at appropriate price points. The investment opportunity is therefore not a single geography, but a distributed ecosystem spanning US architecture, Asian manufacturing depth and EM resource supply.

Where to position now versus later

Given today’s phase, monetisation is happening, but unevenly. For now, near-term earnings visibility remains reliable upstream, supported by scarcity and committed investment. However, the realisation of the full value of current investments ultimately remains contingent on downstream monetisation. Should it fail to materialise at scale, order deferrals, redesigns and cancellations remain possible, particularly if compute requirements evolve or efficiency gains reduce hardware intensity.

Downstream opportunities are larger but more uncertain. Software monetisation is not absent from the cycle, it is delayed. Growth curves may steepen once infrastructure constraints ease, but the dispersion of outcomes remains wide, and winners are not yet clear. In fact, not all participants are likely to survive.

Hence, portfolio construction may benefit from barbell positioning by owning what prints cash now while keeping a stake in what could monetise later. This could be achieved by balancing infrastructure certainty with software possibility, and America’s leadership with Asia’s scale and emerging markets’ resource leverage.

Source HSBC AM, as of January 2026 For informational purposes only and should not be construed as a recommendation to invest in the specific country, product, strategy, sector or security The views expressed above were held at the time of preparation and are subject to change without notice Any forecast, projection or target where provided is indicative only and not guaranteed in any way HSBC Asset Management accepts no liability for any failure to meet such forecast, projection or target

Important information

For Professional Clients and intermediaries within countries and territories set out below; and for Institutional Investors and Financial Advisors in the US. This document should not be distributed to or relied upon by Retail clients/investors.

The value of investments and the income from them can go down as well as up and investors may not get back the amount originally invested. The performance figures contained in this document relate to past performance, which should not be seen as an indication of future returns. Future returns will depend, inter alia, on market conditions, investment manager’s skill, risk level and fees. Where overseas investments are held the rate of currency exchange may cause the value of such investments to go down as well as up. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Economies in Emerging Markets generally are heavily dependent upon international trade and, accordingly, have been and may continue to be affected adversely by trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries and territories with which they trade. These economies also have been and may continue to be affected adversely by economic conditions in the countries and territories in which they trade.

The contents of this document may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. All non-authorised reproduction or use of this document will be the responsibility of the user and may lead to legal proceedings. The material contained in this document is for general information purposes only and does not constitute advice or a recommendation to buy or sell investments. Some of the statements contained in this document may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. We do not undertake any obligation to update the forward looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. This document has no contractual value and is not by any means intended as a solicitation, nor a recommendation for the purchase or sale of any financial instrument in any jurisdiction in which such an offer is not lawful. The views and opinions expressed herein are those of HSBC Asset Management at the time of preparation, and are subject to change at any time. These views may not necessarily indicate current portfolios' composition. Individual portfolios managed by HSBC Asset Management primarily reflect individual clients' objectives, risk preferences, time horizon, and market liquidity. Foreign and emerging markets. Investments in foreign markets involve risks such as currency rate fluctuations, potential differences in accounting and taxation policies, as well as possible political, economic, and market risks. These risks are heightened for investments in emerging markets which are also subject to greater illiquidity and volatility than developed foreign markets. This commentary is for information purposes only. It is a marketing communication and does not constitute investment advice or a recommendation to any reader of this content to buy or sell investments nor should it be regarded as investment research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination. This document is not contractually binding nor are we required to provide this to you by any legislative provision.

All data from HSBC Asset Management unless otherwise specified. Any third party information has been obtained from sources we believe to be reliable, but which we have not independently verified.

HSBC Asset Management is the brand name for the asset management business of HSBC Group, which includes the investment activities that may be provided through our local regulated entities. HSBC Asset Management is a group of companies in many countries and territories throughout the world that are engaged in investment advisory and fund management activities, which are ultimately owned by HSBC Holdings Plc. (HSBC Group). The above communication is distributed by the following entities:

- In Australia, this document is issued by HSBC Bank Australia Limited ABN 48 006 434 162, AFSL 232595, for HSBC Global Asset Management (Hong Kong) Limited ARBN 132 834 149 and HSBC Global Asset Management (UK) Limited ARBN 633 929 718. This document is for institutional investors only, and is not available for distribution to retail clients (as defined under the Corporations Act). HSBC Global Asset Management (Hong Kong) Limited and HSBC Global Asset Management (UK) Limited are exempt from the requirement to hold an Australian financial services license under the Corporations Act in respect of the financial services they provide. HSBC Global Asset Management (Hong Kong) Limited is regulated by the Securities and Futures Commission of Hong Kong under the Hong Kong laws, which differ from Australian laws. HSBC Global Asset Management (UK) Limited is regulated by the Financial Conduct Authority of the United Kingdom and, for the avoidance of doubt, includes the Financial Services Authority of the United Kingdom as it was previously known before 1 April 2013, under the laws of the United Kingdom, which differ from Australian laws;

- in Bermuda by HSBC Global Asset Management (Bermuda) Limited, of 37 Front Street, Hamilton, Bermuda which is licensed to conduct investment business by the Bermuda Monetary Authority;

- in Chile: Operations by HSBC's headquarters or other offices of this bank located abroad are not subject to Chilean inspections or regulations and are not covered by warranty of the Chilean state. Obtain information about the state guarantee to deposits at your bank or on www.cmfchile.cl;

- in Colombia: HSBC Bank USA NA has an authorized representative by the Superintendencia Financiera de Colombia (SFC) whereby its activities conform to the General Legal Financial System. SFC has not reviewed the information provided to the investor. This document is for the exclusive use of institutional investors in Colombia and is not for public distribution;

- in France, Belgium, Netherlands, Luxembourg, Portugal, Greece, Finland, Norway, Denmark and Sweden by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026);

- in Germany by HSBC Global Asset Management (Deutschland) GmbH which is regulated by BaFin (German clients) respective by the Austrian Financial Market Supervision FMA (Austrian clients);

- in Hong Kong by HSBC Global Asset Management (Hong Kong) Limited, which is regulated by the Securities and Futures Commission . T his video/content has not be reviewed by the Securities and Futures Commission;

- in India by HSBC Asset Management (India) Pvt Ltd. which is regulated by the Securities and Exchange Board of India;

- in Italy and Spain by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026) and through the Italian and Spanish branches of HSBC Global Asset Management (France), regulated respectively by Banca d’Italia and Commissione Nazionale per le Società e la Borsa (Consob) in Italy, and the Comisión Nacional del Mercado de Valores (CNMV) in Spain;

- in Malta by HSBC Global Asset Management (Malta) Limited which is regulated and licensed to conduct Investment Services by the Malta Financial Services Authority under the Investment Services Act;

- in Mexico by HSBC Global Asset Management (Mexico), SA de CV, Sociedad Operadora de Fondos de Inversión , Grupo Financiero HSBC which is regulated by Comisión Nacional Bancaria y de Valores;

- in the United Arab Emirates, Qatar, Bahrain & Kuwait by HSBC Global Asset Management MENA, a unit within HSBC Bank Middle East Limited, U.A.E Branch, PO Box 66 Dubai, UAE, regulated by the Central Bank of the U.A.E. and the Securities and Commodities Authority in the UAE under SCA license number 602004 for the purpose of this promotion and lead regulated by the Dubai Financial Services Authority. HSBC Bank Middle East Limited is a member of the HSBC Group and HSBC Global Asset Management MENA are marketing the relevant product only in a sub distributing capacity on a principal-to-principal basis. HSBC Global Asset Management MENA may not be licensed under the laws of the recipient’s country of residence and therefore may not be subject to supervision of the local regulator in the recipient’s country of residence. One of more of the products and services of the manufacturer may not have been approved by or registered with the local regulator and the assets may be booked outside of the recipient’s country of residence.

- in Peru: HSBC Bank USA NA has an authorized representative by the Superintendencia de Banca y Seguros in Perú whereby its activities conform to the General Legal Financial System Law No. 26702. Funds have not been registered before the Superintendencia del Mercado de Valores (SMV) and are being placed by means of a private offer. SMV has not reviewed the information provided to the investor. This document is for the exclusive use of institutional investors in Perú and is not for public distribution;

- in Singapore by HSBC Global Asset Management (Singapore) Limited, which is regulated by the Monetary Authority of Singapore. The content in the document/video has not been reviewed by the Monetary Authority of Singapore;

- In Switzerland by HSBC Global Asset Management (Switzerland) AG. This document is intended for professional investor use only. For opting in and opting out according to FinSA, please refer to our website; if you wish to change your client categorization, please inform us. HSBC Global Asset Management (Switzerland) AG having its registered office at Gartenstrasse 26, PO Box, CH 8002 Zurich has a licence as an asset manager of collective investment schemes and as a representative of foreign collective investment schemes. Disputes regarding legal claims between the Client and HSBC Global Asset Management (Switzerland) AG can be settled by an ombudsman in mediation proceedings. HSBC Global Asset Management (Switzerland) AG is affiliated to the ombudsman FINOS having its registered address at Talstrasse 20, 8001 Zurich. There are general risks associated with financial instruments, please refer to the Swiss Banking Association (“SBA”) Brochure “Risks Involved in Trading in Financial Instruments;

- in Taiwan by HSBC Global Asset Management (Taiwan) Limited which is regulated by the Financial Supervisory Commission R.O.C. (Taiwan);

- in Turkiye by HSBC Asset Management A.S. Turkiye (AMTU) which is regulated by Capital Markets Board of Turkiye. Any information here is not intended to distribute in any jurisdiction where AMTU does not have a right to. Any views here should not be perceived as in vestment advice, product/service offer and/or promise of income. Information given here might not be suitable for all investors and investors should be giving their own independent decisions. The investment information, comments and advice given herein are not part of investment advice activity. Investment advice services are provided by authorized institutions to persons and entities privately by considering their risk and return preferences, whereas the comments and advice included herein are of a general nature. Therefore, they may not fit your financial situation and risk and return preferences. For this reason, making an investment decision only by relying on the information given here in may not give rise to results that fit your expectations.

- in the UK by HSBC Global Asset Management (UK) Limited, which is authorised and regulated by the Financial Conduct Authority;

- and in the US by HSBC Global Asset Management (USA) Inc. which is an investment adviser registered with the US Securities and Ex change Commission.

- In Uruguay, operations by HSBC's headquarters or other offices of this bank located abroad are not subject to Uruguayan inspections or regulations and are not covered by warranty of the Uruguayan state. Further information may be obtained about the state guarantee to deposits at your bank or on www.bcu.gub.uy.

Copyright © HSBC Global Asset Management Limited 2025. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of HSBC Global Asset Management Limited.

Content ID: D061960_V1.0; Expiry date: 31.12.2026.