Investment Monthly

Summary

Macro Outlook

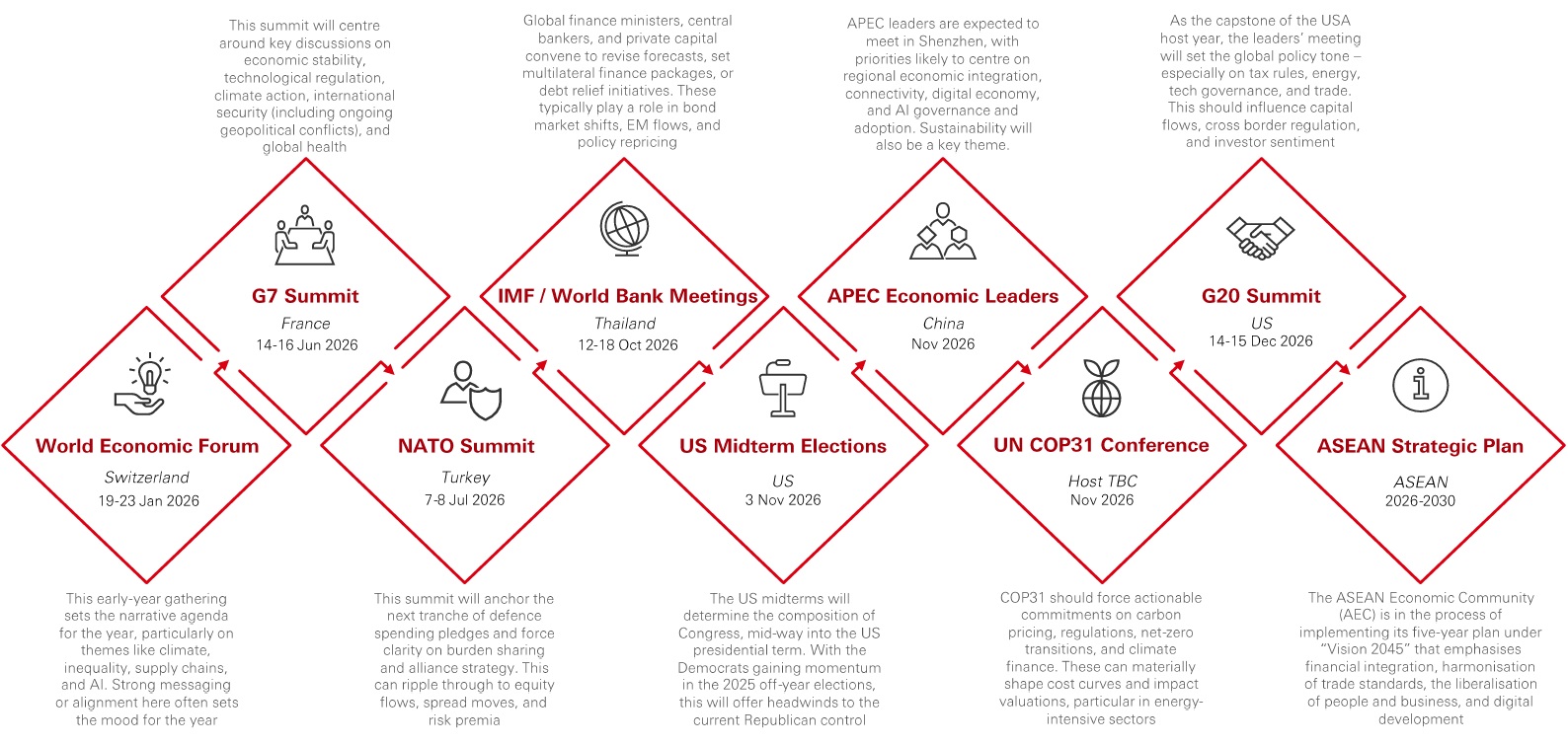

- The US is expanding at a solid pace, but growth is unbalanced. AI-related capex is providing strong support, but a cooling labour market and tariff-driven price rises are a headwind to consumers

- We expect US growth to converge towards rates seen in other developed economies. Tariffs pose upside risks to inflation

- In China, we expect resilient but uneven growth, as supportive macro policies and export/manufacturing competitiveness offset tariff headwinds

- We think premium growth opportunities lie in emerging and frontier markets, with economic power shifting to Asia and the Global South

Policy Outlook

- The US Fed is divided over the rate outlook, reflecting differing views on the medium-term trajectory for inflation and the labour market

- After eight rate cuts, eurozone inflation is close to target and policy is in neutral territory, with the ECB taking a “watch-and-wait” stance

- EM Asia has increased fiscal and industrial support to offset trade headwinds, as the region enters the late stages of its monetary easing cycle

- China will rely on incremental and targeted policy to support economic and financial stability. Policy efforts will focus on strategic objectives such as technology innovation and self-reliance, and economic rebalancing

House View

- We expect a "role reversal" in areas of the macro and policy environment, with US leadership fading and market performance more dependent on profit and credit fundamentals rather than bullish sentiment

- Market leadership and corporate profits will keep "broadening out" as growth converges in the west, and builds in Asia and other emerging markets. Economic derisking and improved policy frameworks have made those regions structurally safer and less volatile

- With government bonds potentially less reliable as a portfolio hedge, multi-asset investors should manage the challenge of volatility by seeking to "diversify the diversifiers" with bond substitutes like hedge funds, infrastructure, and other real assets

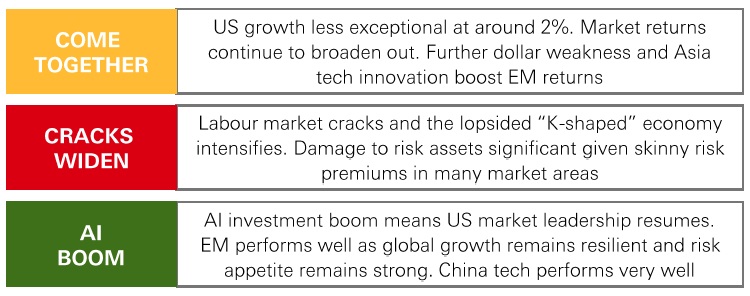

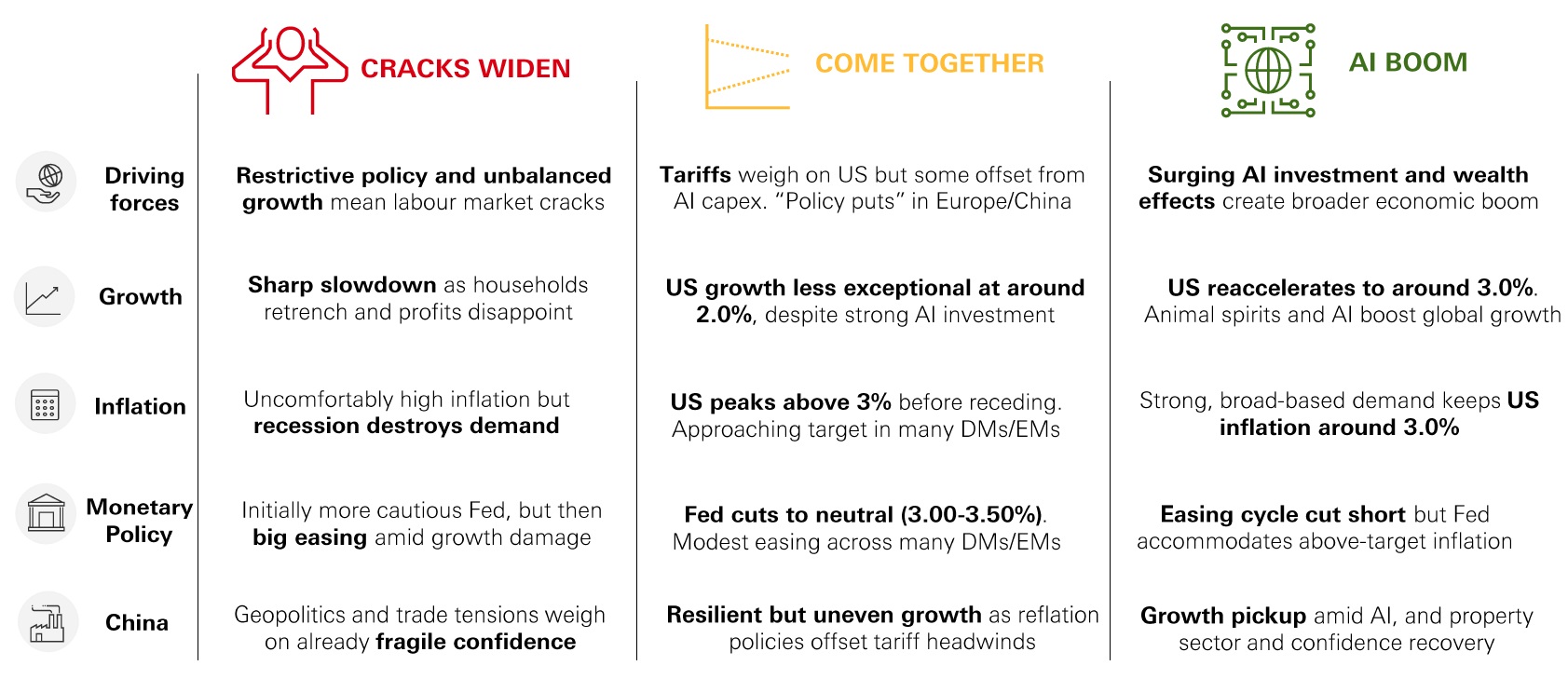

Scenarios

Click the image to enlarge

Source: HSBC Asset Management as at December 2025. The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. The views expressed above were held at the time of preparation and are subject to change without notice. Diversification does not ensure a profit or protect against loss. This information shouldn't be considered as a recommendation to invest in the country or sector shown. This information shouldn't be considered as a recommendation to invest in the country or sector shown.

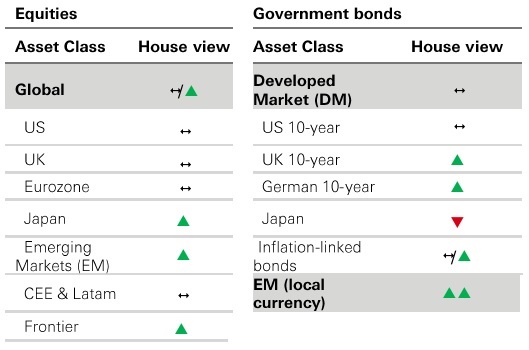

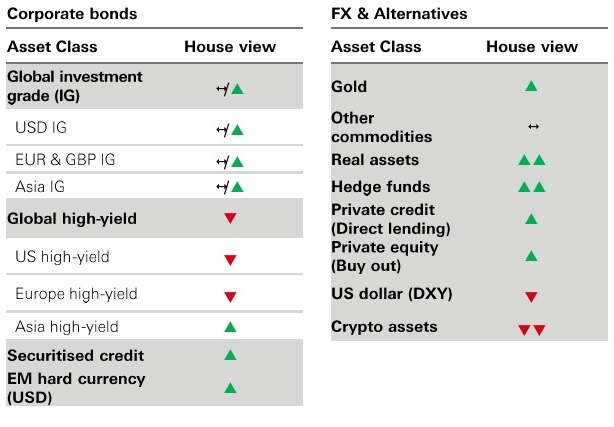

House View

We expect a role reversal in areas of the macro, policy, and market environment next year as US growth leadership fades. Market performance and profits will continue to broaden out globally, with structural improvements helping to drive emerging markets. Investors should seek out new diversifiers to build stronger portfolio resilience and returns.

- Equities - AI enthusiasm may continue to support US stock market performance, but a high concentration in tech names and lofty valuations are potential risks. Global GDP and profits growth is expected to broaden out, supporting our preference for stocks in emerging and frontier markets

- Government bonds - We expect developed market bond yields to remain sticky amid inflation risks and elevated debt. We think EM local currency bonds benefit from lower inflation, stronger growth and improved debt sustainability

- Corporate bonds - Investment grade corporate credit spreads remain tight, but strong technicals and healthy balance sheets are supportive. We maintain a defensive stance with a preference for higher quality credits

Click the image to enlarge

Click the image to enlarge

Click the image to enlarge

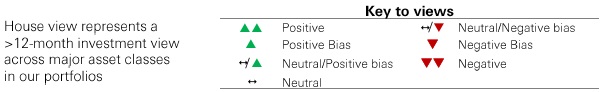

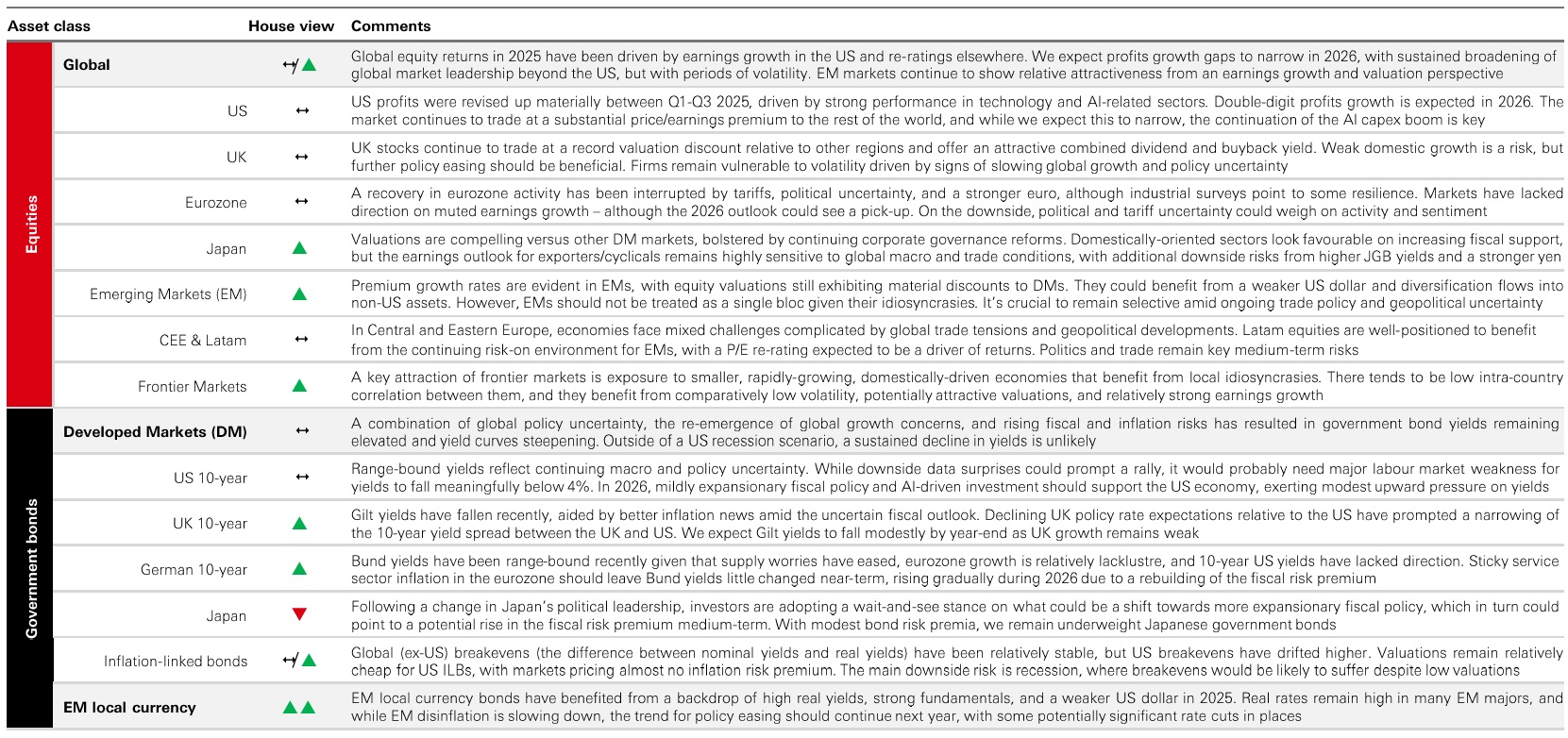

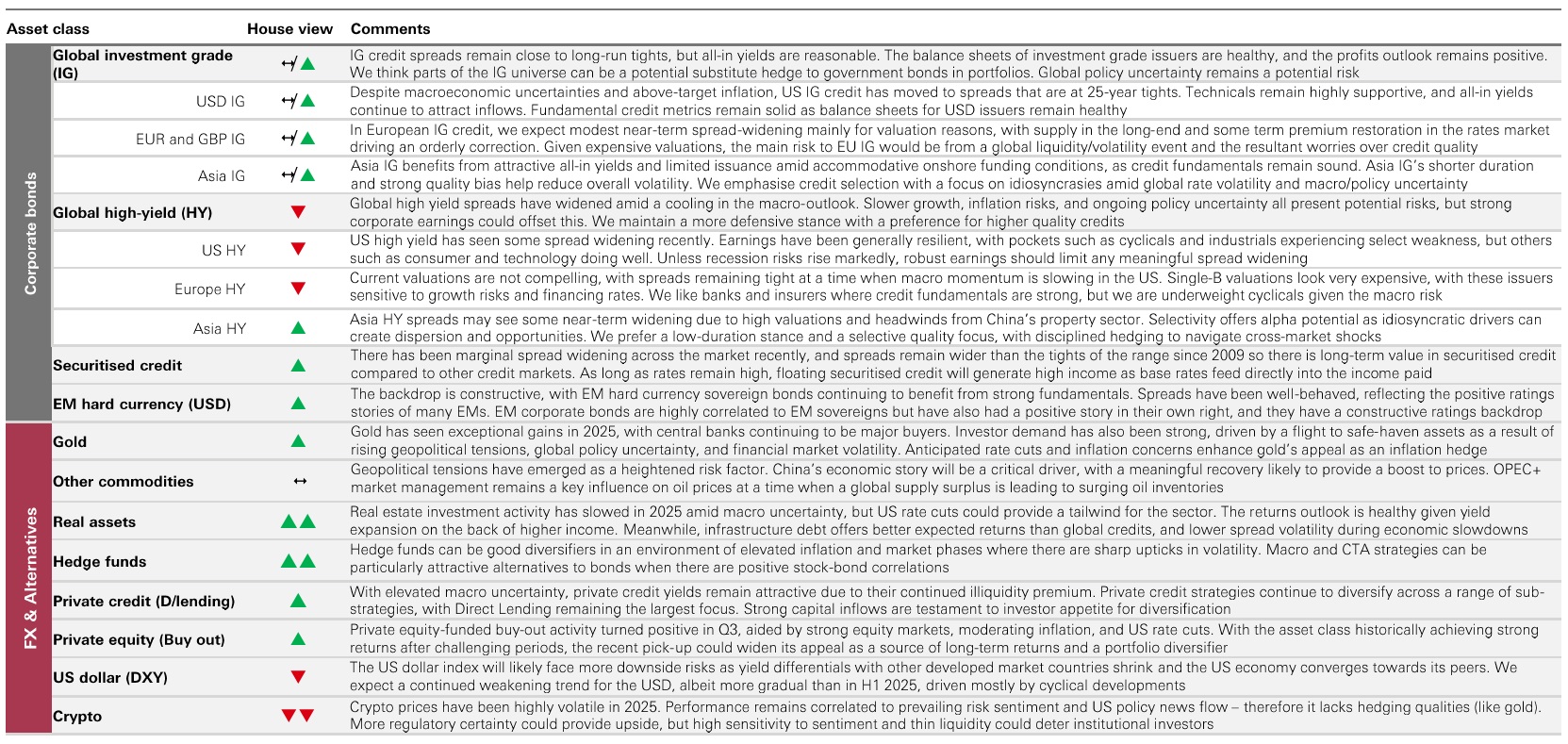

House view represents a >12-month investment view across major asset classes in our portfolios.

Source: HSBC Asset Management as at December 2025. The level of yield is not guaranteed and may rise or fall in the future. Any forecast, projection or target where provided is indicative only and not guaranteed in any way. The views expressed above were held at the time of preparation and are subject to change without notice. This information shouldn't considered as a recommendation to invest in the country or sector shown. Diversification does not ensure a profit or protect against loss.

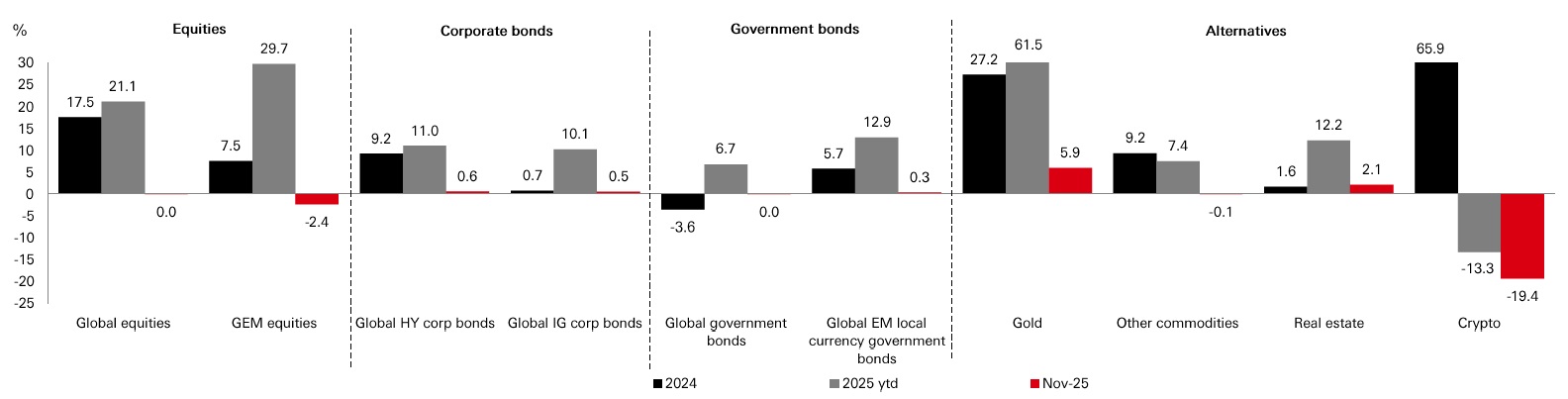

Asset class performance at a glance

Global stocks were volatile in November on jitters over stretched tech valuations, huge AI capex commitments, and the outlook for US growth. Market returns were broad-based, with positive moves in emerging markets and Europe. US Treasury 10-year yields saw a modest fall, while crypto currency process fell sharply.

- Government bonds - Sovereign bonds in key markets were range-bound, with 10-year yields edging lower in the US, but higher in Germany and Japan. Fiscal and inflation risks, and a cooling growth outlook are keeping investors on edge

- Equities - Volatility spiked, with a tech-led sell-off followed by a broad recovery. US large-caps finished flat, with tech weakness spilling into China, Korea, and Taiwan. there were positive moves in Latam, India, Frontier, and parts of Europe

- Alternatives - November saw a renewed rally in the gold price and a major sell-off in cryptocurrencies, with Bitcoin's historically close correlation to the tech-heavy Nasdaq index breaking down. In real assets, Infrastructure performed well

Click the image to enlarge

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. This information shouldn't be considered as a recommendation to invest in the country or sector shown. The views expressed above were held at the time of preparation and are subject to change without notice.

Source: Bloomberg, all data above as at close of business 30 November 2025 in USD, total return, month-to-date terms. Note: Asset class performance is represented by different indices. Global Equities: MSCI ACWI Net Total Return USD Index. Global Emerging Market Equities: MSCI Emerging Market Net Total Return USD Index. Corporate Bonds: Bloomberg Barclays Global HY Total Return Index value unhedged. Bloomberg Barclays Global IG Total Return Index unhedged. Government bonds: Bloomberg Barclays Global Aggregate Treasuries Total Return Index. JP Morgan EMBI Global Total Return local currency. Commodities and real estate: Gold Spot USD/OZ, Other commodities: S&P GSCI Total Return CME. Real Estate: FTSE EPRA/NAREIT Global Index TR USD. Crypto: Bloomberg Galaxy Crypto Index.

Macro scenarios

Click the image to enlarge

Click the image to enlarge

Source: HSBC Asset Management, December 2025.

The commentary and analysis presented in this document reflect the opinion of HSBC Asset Management on the markets, according to the information available to date. They do not constitute any kind of commitment from HSBC Asset Management. Consequently, HSBC Asset Management will not be held responsible for any investment or disinvestment decision taken on the basis of the commentary and/or analysis in this document. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecast, projection or target.

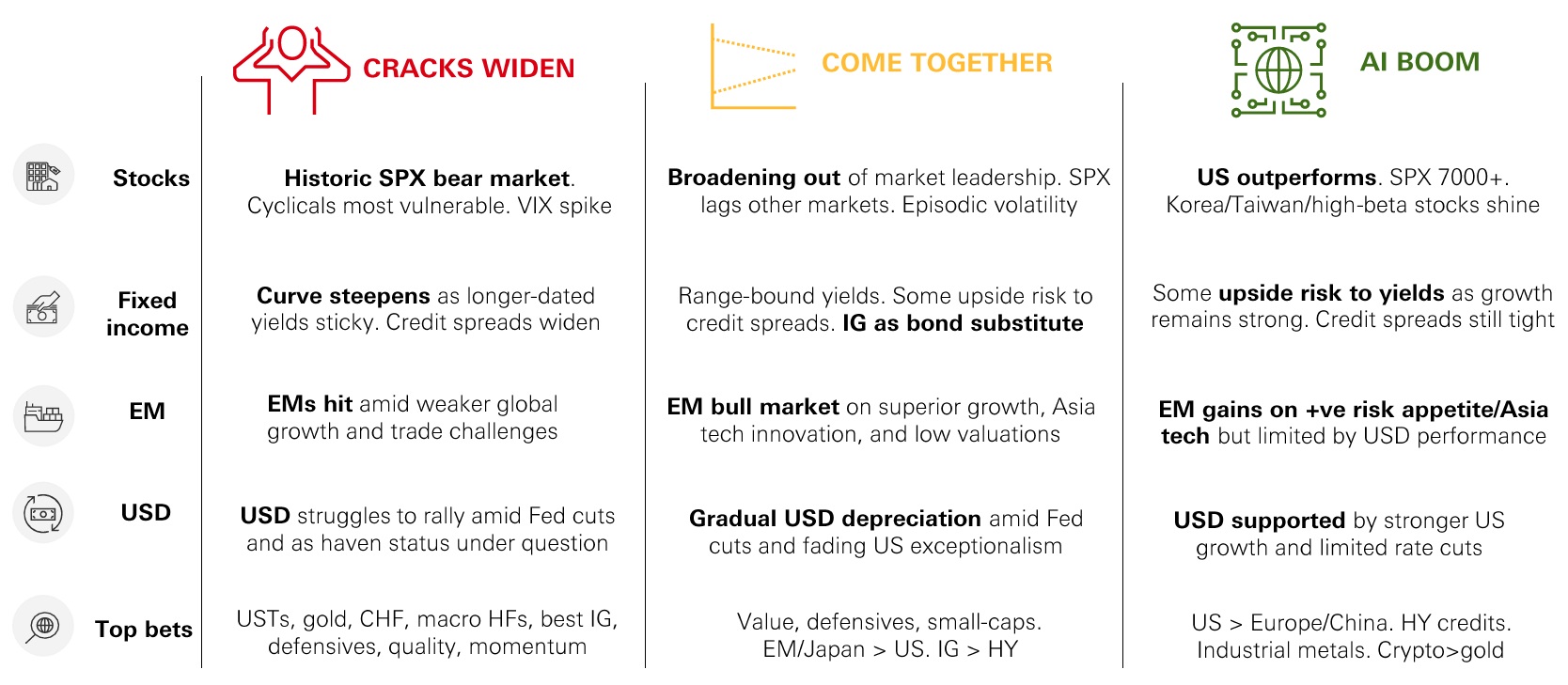

Economic outlook

A divided Federal Reserve

Click the image to enlarge

Past performance does not predict future returns.

Source: HSBC Asset Management, consensus numbers from Bloomberg, December 2025. Any views expressed were held at the time of preparation and are subject to change without notice. While any forecast, projection or target where provided is indicative only and not guaranteed in any way. HSBC Asset Management Limited accepts no liability for any failure to meet such forecast, projection or target. This information shouldn't be considered as a recommendation to invest in the specific country mentioned.

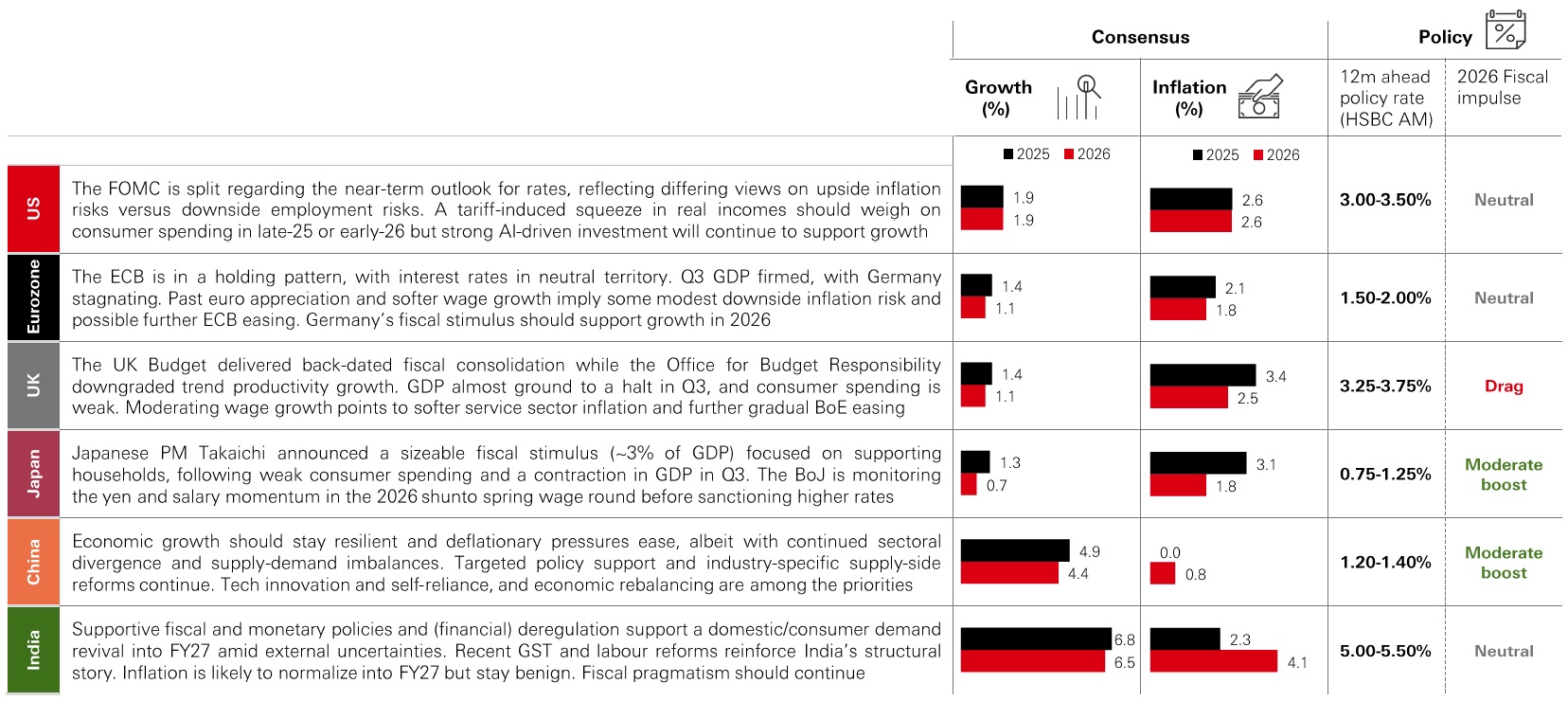

Events to look out for in 2026

Click the image to enlarge

Source: HSBC Asset Management, December 2025.

The views expressed above were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecast, projection or target. Past performance does not predict future returns.

Asset class positioning

Click the image to enlarge

Click the image to enlarge

Click the image to enlarge

Click the image to enlarge

Source: HSBC Asset Management as a t December 2025. The level of yield is not guaranteed and may rise or fall in the future. Diversification does not ensure a profit or protect against loss. The views expressed above were held at the time of preparation and are subject to change without notice. This information shouldn't be considered a s a recommendation to invest in the country or sector shown.

On Top of Investor's Minds

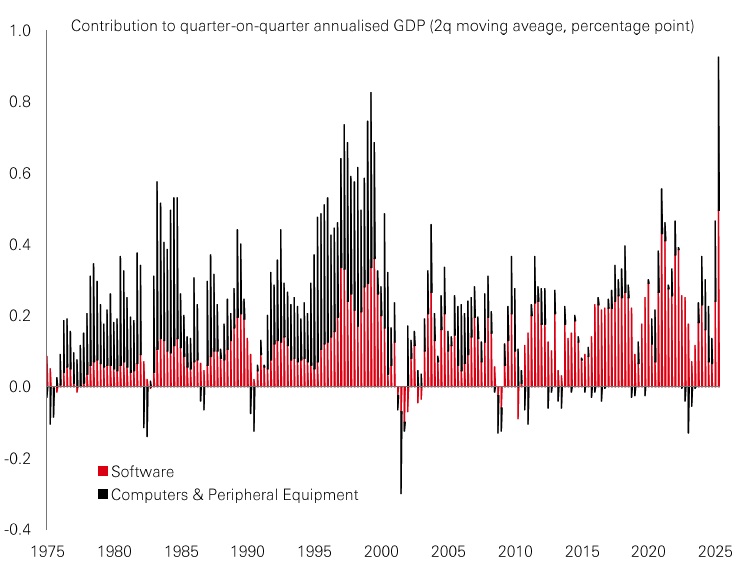

US tech stocks have recently been volatile. What's next for the sector?

Global technology stocks have been volatile recently. We think several factors could keep investors on edge into 2026.

- Continuing massive Al-related capex investment is exacerbating concerns over the return on investment and the possibility of overspending

- The US economy has become "K-shaped", with the "losing arm" including lower-income families and struggling firms

- US tech stock valuations are high, and they are skewing the overall market. Most major global indices now trade at a significant price/earnings valuation discount to the US

- While policy uncertainty has fallen this year, key questions remain — particularly on issues of Federal Reserve independence, and divergent FOMC views on labour and inflation

- The moat around US tech dominance looks to be shrinking. Competition from China, particularly on new Al-related innovation, is a growing challenge to US dominance

So, although the US market outlook is boosted by Al and the strong revenue generation that comes with it, these big uncertainties imply significant valuation risks. We think opportunities in the global technology sector - especially in Asia — could be just as profitable, but with lower downside potential.

Tech investment contribution to US GDP growth

Click the image to enlarge

Source: HSBC Asset Management as at December 2025. The views expressed above were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and not guaranteed in any way. Diversification does not ensure a profit or protect against loss. This information shouldn't be considered as a recommendation to invest in the country or sector shown.

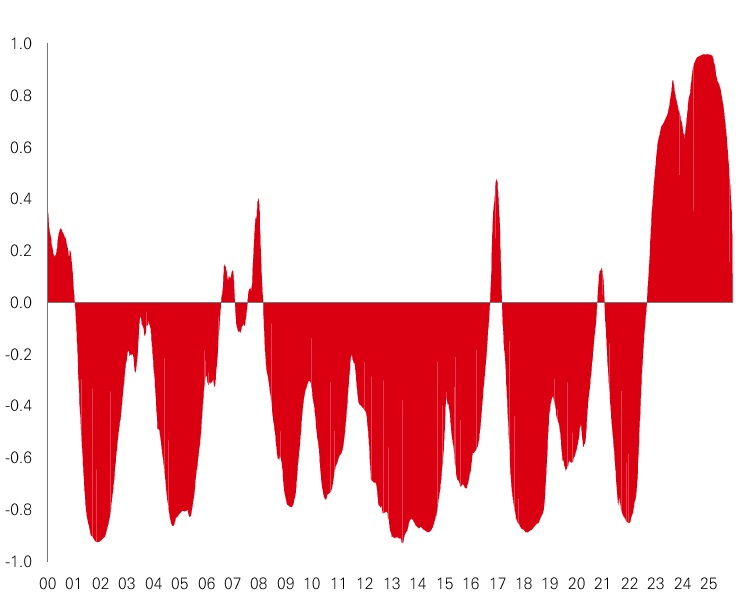

Should investors worry about rising public debt?

The recent drama surrounding the UK Budget reflects an uncomfortable truth for many Western governments: the combination of weak growth, rising debt, sticky inflation, and higher interest rates has made balancing the books increasingly challenging for Treasury departments.

A full-blown debt crisis remains unlikely. But volatility is likely to be higher than during the 2010s as bond investors navigate a more uncertain macro environment and government pressure to maintain fiscal activism.

Governments may also "test" the markets in rolling out policies which could be deemed as fiscally irresponsible e.g. major unfunded tax cuts, or spending increases. This is especially relevant in a backdrop of strong populist movements in the West.

Overall, with the safety properties of government bonds now looking weaker than in the past, and the stock-bond correlation now positive (i.e. stocks falling alongside bonds), multi asset investors will need to look for "bond substitutes". These can include liquid alternatives such as gold or hedge funds. Real assets such as listed infrastructure are well placed to navigate a higher inflation scenario, white private assets benefit from structurally low volatility, with private equity benefiting from Fed rate cuts.

Rolling 18-month S&P 500/US 10-year correlation

Click the image to enlarge

Source: HSBC Asset Management as at December 2025. * US tech represents US-DataStream Technology index. The views expressed above were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and not guaranteed in any way. Diversification does not ensure a profit or protect against loss. This information shouldn't be considered as a recommendation to invest in the country or sector shown.

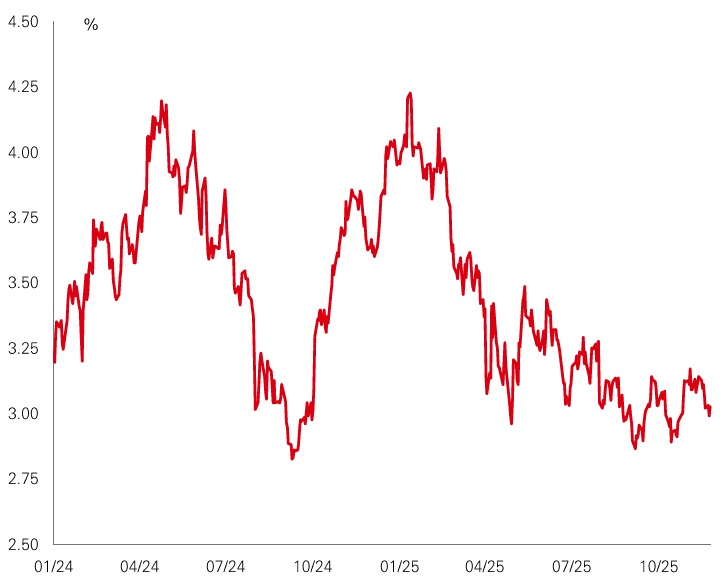

What's the outlook for further Fed rate cuts?

The good news for global investors is that policy uncertainty measures are falling back. Following the seismic shock that was April's "Liberation Day" tariff announcements, trade policy is now less topical for investors.

But that doesn't mean policy uncertainty has dissipated completely. In particular, the outlook for the Fed remains clouded by questions around the impact of political interference, and increasingly divergent views on the FOMC around the state of the labour market and inflationary pressures in the economy, further complicated by the impact of Al.

Indeed, recent market volatility has coincided with several hawkish comments from Fed officials, with some concern over still-high levels of inflation. This follows Fed Chair Powell noting a December rate cut is far from a foregone conclusion in his October meeting press conference.

Crucially, however, the longer-term outlook remains broadly unchanged, with investors still expecting the Fed Funds Rate to drop to around 3 per cent by the end of next year. But any disappointment on the inflation front, or persistently cautious and hawkish messaging from the Fed, could create more significant market turbulence.

Market expectations of Fed funds rate by December 2026

Click the image to enlarge

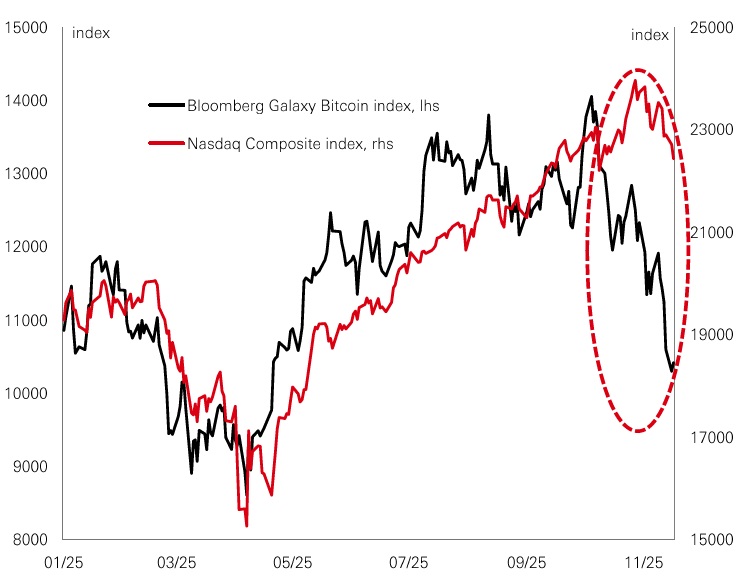

How should we interpret the latest fall in crypto prices?

Since hitting an all-time high in early October, the Bloomberg Galaxy Bitcoin index — which tracks the USD value of Bitcoin — has slumped by around 30 per cent. The move has wiped out all of Bitcoin's gains year-to-date.

It marks another twist in a rollercoaster year for the crypto coin, which has benefited from strong retail inflows via ETFs, and the tailwind of Fed policy easing. US legislative support with the GENIUS Act, and vocal backing from the US administration have also boosted sentiment. But its high sensitivity to macro and market sentiment have seen sharp sell-offs, particularly after April's 'Liberation Day' US tariff announcements. The latest collapse coincided with uncertainty over whether the US Fed will cut rates again in December.

An interesting feature of the move is that Bitcoin's usually close correlation to the Nasdaq equity index — and its tendency to trend with tech stocks — has been disrupted. It could mark the start of a new regime where Bitcoin takes its own, more unpredictable path. But the more troubling scenario would be the possibility it drags US tech down with it, for example if crypto holders liquidate stock holdings to fund margin calls. As we head into 2026, this is one area of financial markets worth monitoring.

Nasdaq Composite versus Bitcoin

Click the image to enlarge

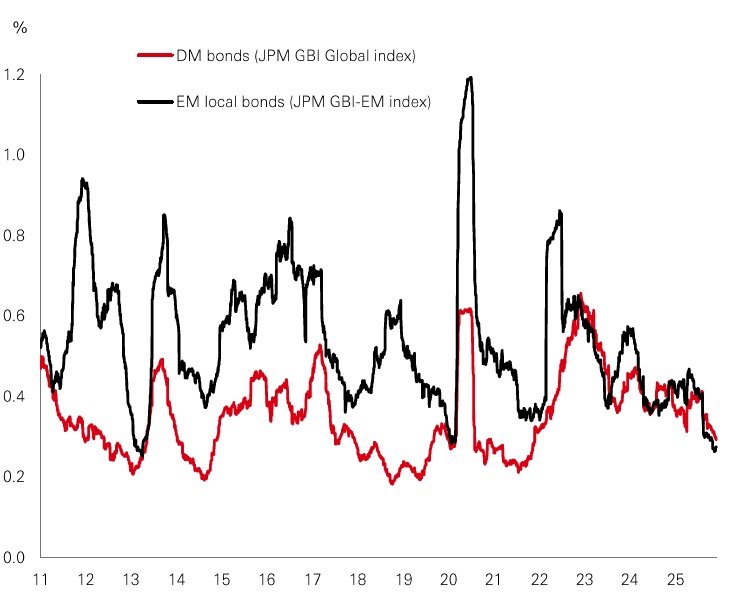

After a bumper year for EM returns, what next for EMs in 2026?

After this year's mega returns across the EM asset universe, it's worth looking ahead to 2026 and asking the question: can the rally continue? A key question then is how much of the good performance in EM has been because of luck, or because EM is good?

In reality, the answer is probably a bit of both. Lucky because a weaker dollar has clearly helped performance. We know that it loosens financial conditions for EMs, and encourages capital to flow downhill. The good news is there is room for further gradual falls given ongoing Fed cuts and evidence the currency is still overvalued. But good because macro derisking has been a big achievement too, reflected in EM asset classes showing lower volatility than developed markets.

But it would also be naive to not recognise some of the challenges for emerging markets in 2026. China is still challenged by deflation. Secondly, we also have trade risks. Tariffs have dropped off the radar for investors a bit recently. And we've seen more of a regionalisation in Asia trade flows, for example. But 2026 will be a busy year for geopolitics, so we'll need to watch that closely.

And finally, investors will want to see that the expected strong GDP growth and profit rates are being delivered too.

Bond market total return volatility (90 day rolling measure)

Click the image to enlarge

Source: HSBC Asset Management as at December 2025. The views expressed above were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and not guaranteed in any way. Diversification does not ensure a profit or protect against loss. This information shouldn't be considered as a recommendation to invest in the country or sector shown.

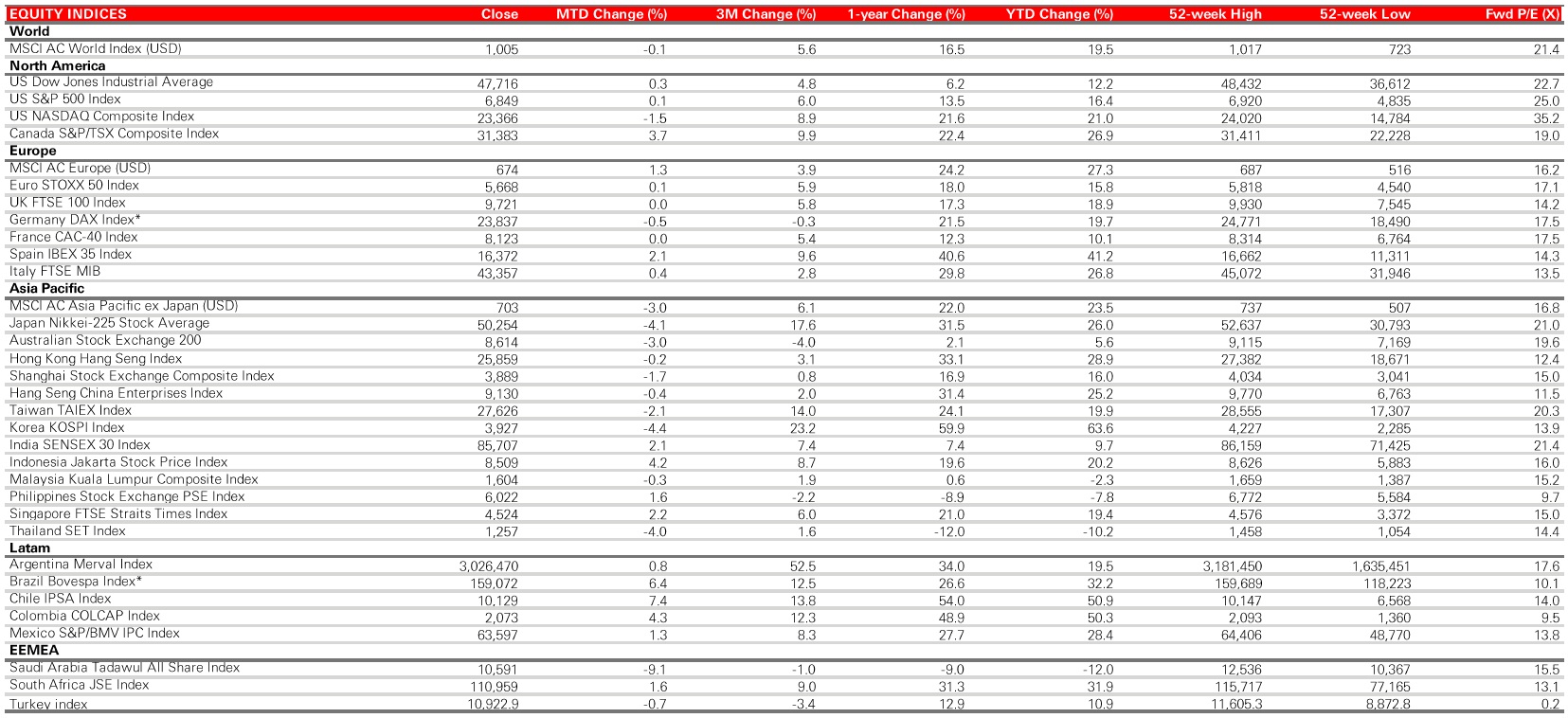

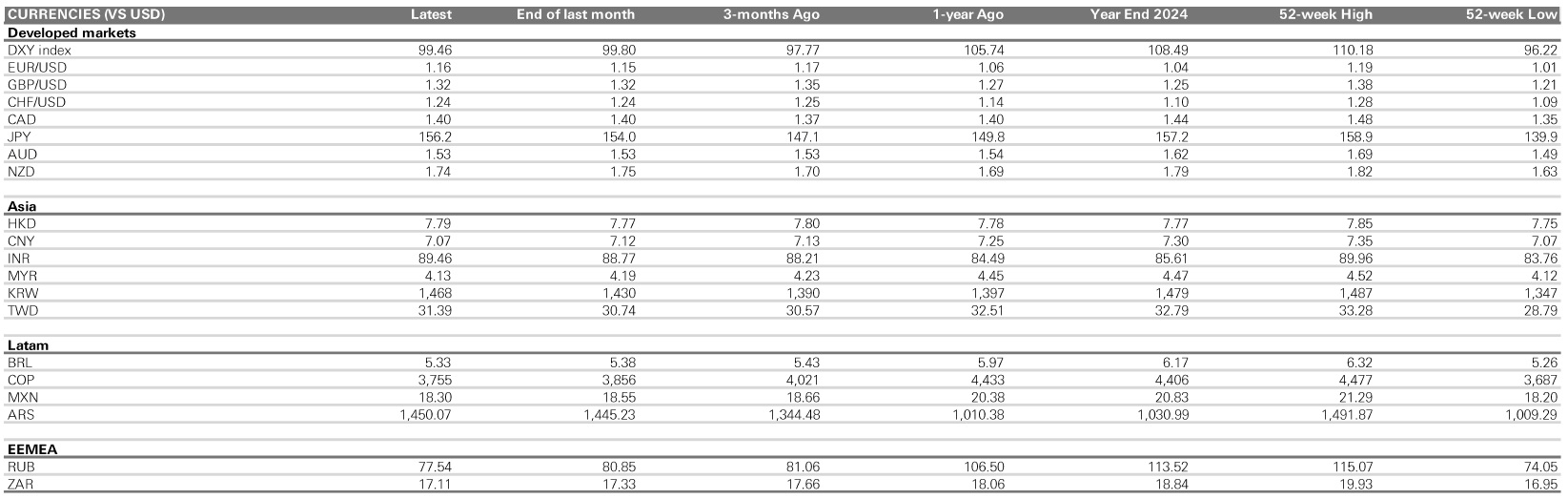

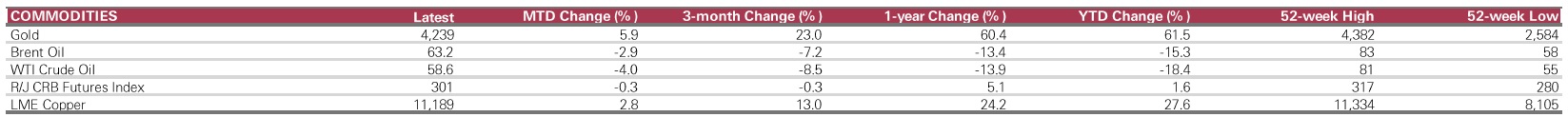

Market Data

November 2025

Click the image to enlarge

Sources: Bloomberg, HSBC Asset Management. Data as at close of business 30 November 2025. (*) Indices expressed as total returns. All others are price returns.

Past performance does not predict future returns. The level of yield is not guaranteed and may rise or fall in the future. This information shouldn't be considered as a recommendation to invest in the country or sector shown.

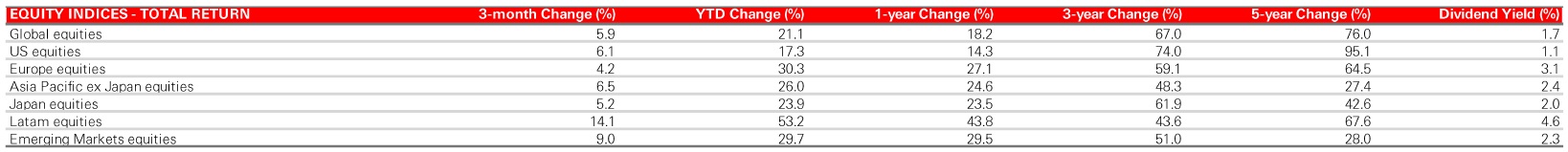

Click the image to enlarge

All total returns quoted in USD terms.

Data sourced from MSCI AS World Total Return Index, MSCI USA Total Return Index, MSCI AC Europe Total Return Index, MSCI AS Asia Pacific ex Japan Total Return Index, MSCI Japan Total Return Index, MSCI Latam Total Return Index and MSCI Emerging Markets Total Return Index.

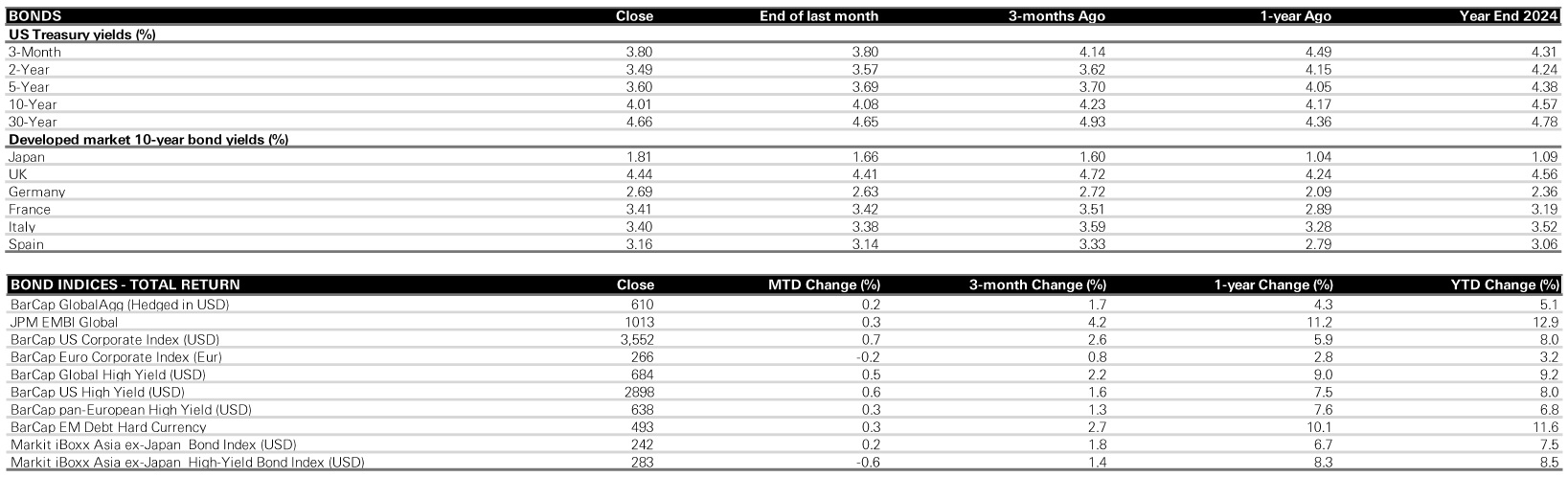

Click the image to enlarge

Sources: Bloomberg, HSBC Asset Management. Data as at close of business 30 November 2025. Total return includes income from dividends and interests as well as appreciation or depreciation in the price of an asset over the given period. Past performance does not predict future returns. the level of yield is not guaranteed and may rise or fall in the future. This information shouldn't be considered as a recommendation to invest in the country or sector shown.

Click the image to enlarge

Click the image to enlarge

Sources: Bloomberg, HSBC Asset Management. Data as at close of business 30 November 2025.

Past performance does not predict future returns. the level of yield is not guaranteed and may rise or fall in the future. This information shouldn't be considered as a recommendation to invest in the country or sector shown.