Tariffs, Taxes, President Trump and Transmission

Executive summary:

It has been a busy start to the year for global financial markets with no shortage of significant catalysts emanating from the United States. Geopolitical developments have attracted headlines around the world and driven macro sentiment, whilst there has also been no shortage of political matters impacting domestic sectors and stocks. The back and forth on tariffs, the budget reconciliation bill (or “the One Big Beautiful Bill”), and the steady stream of Executive Orders from the President have all caught investors’ attention. State politics has also been particularly active ahead of several key elections this year and next; pursuing economic growth and dealing with cost-of-living pressures important areas of focus for most. The rapid expansion of the data centre industry is in some ways related to these efforts and continues despite the concerns from the Deepseek announcement in Mar-25. Despite this the buildout continues and has been so significant that data centre construction added 1% of growth to the world’s largest economy in the first quarter of 2025 .

These topics have all been important for the profitability and outlook of the US utilities that we follow and invest and it was in this environment that we travelled to the US in 2Q25. Our discussions with those in the industry covered the implications of these issues and more, at a time when many were still evolving. The conversations were also in the context of the evolving energy transition involving topics addressed in our 2022 energy transition thought piece, specifically in relation to gas and nuclear. Similarly, the increasing focus on affordability and the challenges from different drivers of power bills were called out in our paper from last year on the same topic. Whilst the quickly evolving data centre industry and its impact on power demand remains a key theme, as we analysed in our report of a few months ago. We provide below some of our feedback on these topics and others as we continue to closely follow developments for the analysis of our investments in the sector.

This document provides a high level overview of the recent economic environment. It is for marketing purposes and does not constitute investment research, investment advice nor a recommendation to any reader of this content to buy or sell investments. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination. The views expressed above were held at the time of preparation and are subject to change without notice. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. HSBC Asset Management accepts no liability for any failure to meet such forecast, projection or target.

1 Apollo, 2025

Tariffs have had limited direct impact to the sector, but potentially longer-term implications

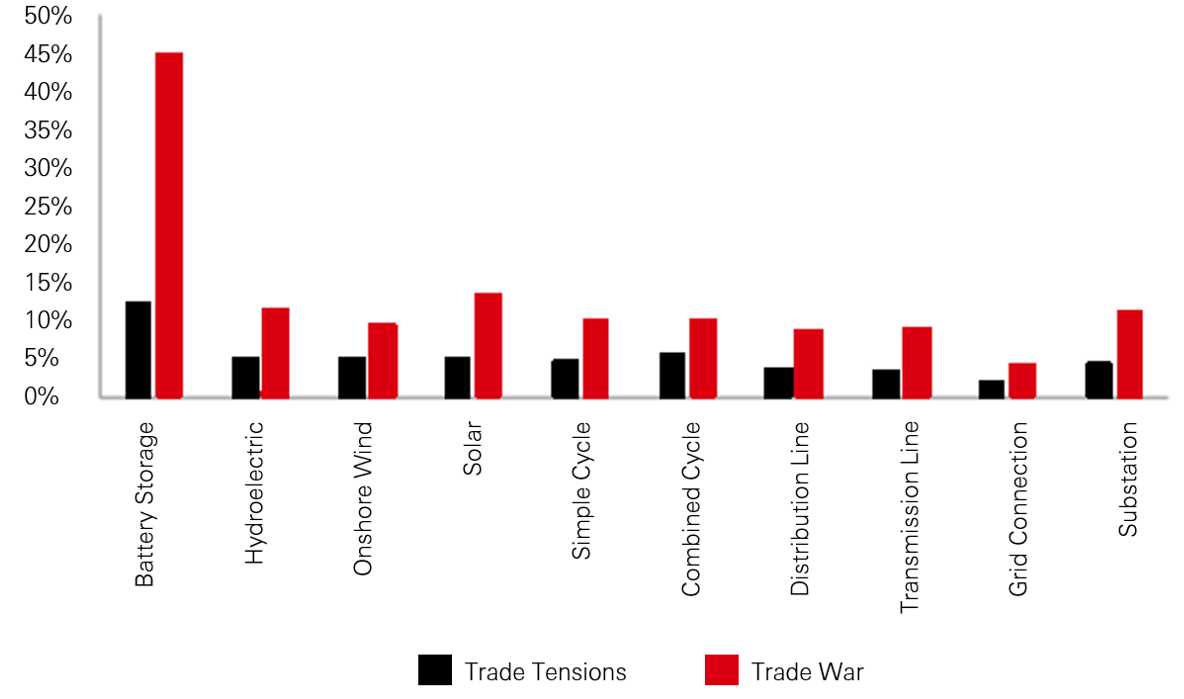

The new Administration’s focus on tariffs as a policy tool has received a lot of attention from the media and markets so far in 2025. However, it wasn’t until utility management teams addressed investors with their 1Q25 results that we formally heard of the expected financial impact. Given labour is the main component of operating expenses for utilities the impact to procurement was more of a capital item, and most companies provided a range that fell within 2–5% of their long-term (4–5 years) capex plans. These levels (at that time) are very manageable for our companies, resulting in either a little more bill inflation for customers or potentially the deferral of less-critical projects.

Feedback from many management teams was that they had been focused on their supply chain strategies in advance of the various announcements from the President and the expected increases could yet be managed lower. Indeed, policies implemented by the previous Administration had incentivised re-shoring of manufacturing, supporting the potential for increased domestic supplies. For US utilities with cost of service-based regulation the extent to which materials can’t be procured at prices and quality that differ to international standards is a potential risk borne by the customer and will require further monitoring. Batteries are a good example of this where the domestic industry in the US is at the early stages of development and a technology that will clearly be in increasing demand going forward given the recent build-out of renewables and expectations for the future.

Chart 1: Expected impact of tariff scenarios on utility construction costs (Wood Mackenzie, 2025)

OBBBA repeal of IRA level tax credits is the main focus for utilities

During the pause in implementation of tariffs beyond the 10% baseline, attention turned to the Republican party’s One Big Beautiful Bill (OBBBA) initiative. A budget reconciliation bill, the OBBBA effectively implements policy with regards to the federal budget. Following rhetoric during the election campaign, tax credits for renewables and other technologies that were introduced or extended under the previous Administration’s Inflation Reduction Act (IRA) were expected to come under close scrutiny and potentially repealed in some way. However, despite the strong language towards renewables from the President this was less straight forward than it seemed given Republican states disproportionally benefited from investments that flowed from the IRA. As a result, this was one of the more contentious areas of the bill, resulting in much back and forth within the party around different versions of a phaseout.

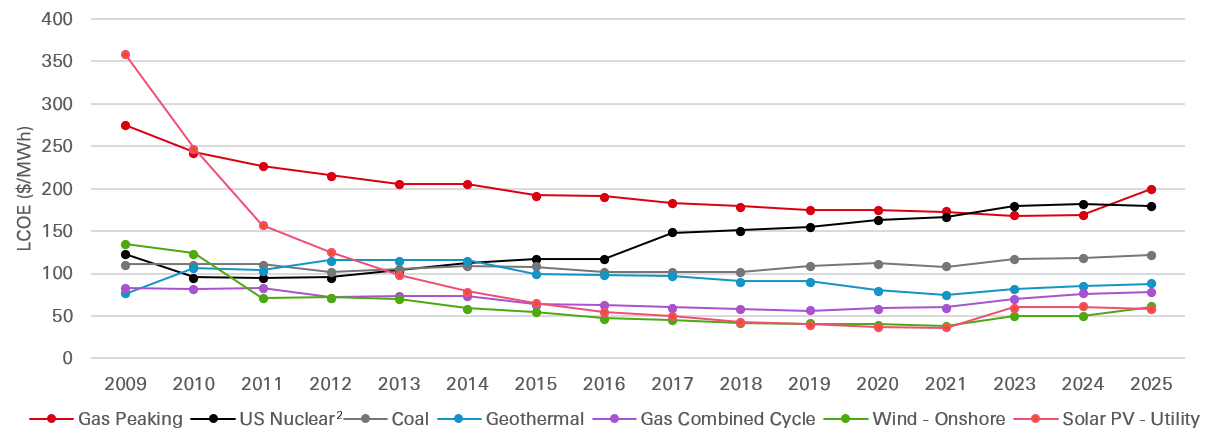

The final legislation provides for tax credits for renewables projects commencing construction within 12 months of OBBBA enactment or in service by the end of 2027. However, safe harbouring provisions are expected to still apply such that projects that have commenced construction will still be eligible for credits if completed within 4 years. The perspective from a lot of utilities was that this was better than originally feared and supportive of their publicly stated capex plans (usually 4–5 years), significant, given these projects form a meaningful component for many. However, management teams acknowledged the lost credits thereafter would increase the cost of renewable generation, which would eventually be incorporated into their regularly updated longer-term resource plans. Even so, renewables are expected to remain the cheapest incremental resource – and the fastest to market with a current shortage of gas turbines – such that the additional expense from the lost tax credits will be borne by the consumer.

Meanwhile, amongst the other tax credits introduced by the IRA those for nuclear have been retained to the original 2032 expiry, an important development for those assets and the potential for new nuclear capacity. This was well-received by owners of nuclear generation, including many utilities, even if not significant enough by itself to encourage investment beyond the optimisation of existing assets. Tax credits for battery storage were also spared from the repeal efforts, an important potential offset for any tariff implications.

Chart 2: Levelised Cost of Energy (LCOE) evolution (Lazard, 2025)

2 E2, 2024

President Trump's EO's not directly impactful but bare monitoring

The President has also been active directing policy via a plethora of Executive Orders (EO’s), several of which have had implications for the utilities sector. Those most notable in this regard were focussed on stimulating development in the nuclear and coal industries, whilst a third looked to check the support for renewables development. All technologies are at very different stages of their life cycle. Coal has been challenged by various environmental regulations and mandates in recent years which has resulted in accelerating retirements and no new build, whilst nuclear has seen something of a resurgence following a period of limited new investment and a focus now on new technologies. Meanwhile renewables have seen rapid growth over a number of years from supportive tax credits, that were extended by the IRA.

The EO’s for coal and nuclear were positive for sentiment and include some small “wins” for each industry (e.g. relaxed regulations and faster permitting) but neither are likely to significantly alter the existing trends. However, the view from the utilities sector was that new coal is still very unlikely, however, some retirements will probably get deferred (also a function of security of supply concerns with increasing demand). Whilst for nuclear, utilities are following developments with Small Modular Reactor (SMR) technologies closely, though they remain highly averse to First of a Kind risks and unlikely to be pursued until more established. The EO for renewables was more recent and developments will need to be followed closely as will future policy developments from the President.

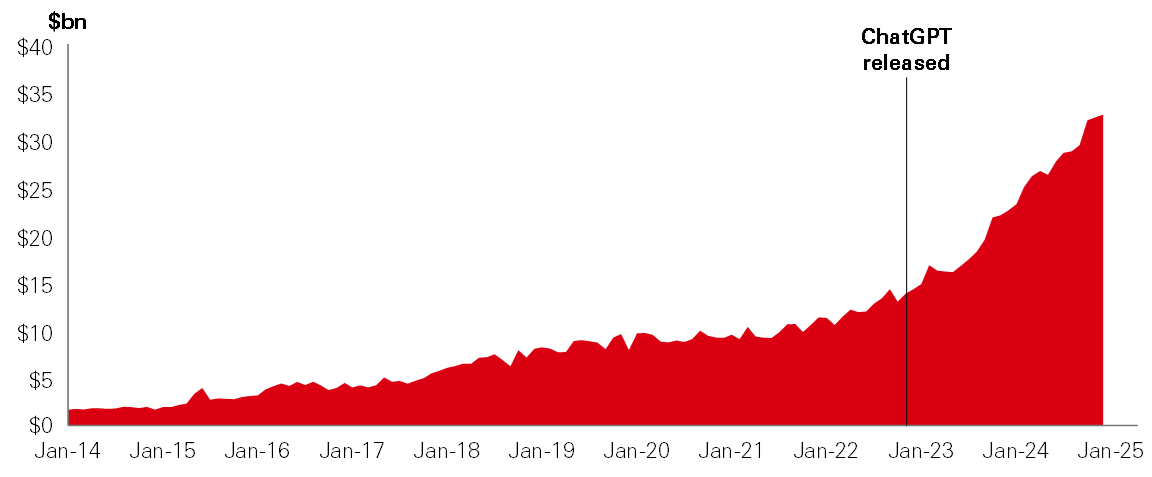

Data centres are driving demand growth, whilst impacts on affordability a point of caution

As policy developments dominated the supply side of the discussion, the outlook for demand continues to improve, with data centres remaining a key driver of this growth. Almost all utilities we met with spoke to their improving demand outlook due to different degrees of data centre, electrification and re-shoring/advanced manufacturing growth. Generally, this is a positive dynamic for utilities as the largely fixed costs (particularly from transmission and distribution networks) are shared over a larger customer base and therefore have the effect of lowering bills. However, eventually the additional growth will require further investment, be it on the grid or additional supply, and the extent to which this can be offset by increased revenues from additional demand will determine how positive an outcome it might be for all stakeholders.

Chart 3: US private data centre construction expenditure latest demand growth expectations (US census bureau, 2025)

This has been a notable dynamic from the increased data centre demand, where they bring large loads but pay a significantly lower tariff and may require large investments. For the utilities, balancing these effects such that existing customers don’t subsidise new demand has been critical to the success of data centre deals and the support from regulators, politicians and other stakeholders. Where power is sourced from capacity and/or energy markets these circumstances are a little more challenging as a lack of new baseload generation investment in recent years has meant rising demand is putting upwards pressure on prices. These more meaningful price increases have been starting to flow into the pass-through component of utility bills in recent months, which has resulted in the associated media and political attention. Utilities operating in these markets have been sensitive to these pressures and working with regulators to address the affordability concerns, including respite for certain customers and focussing investments where they can potentially help reduce bills.

Affordability and resource adequacy; states governments are poised to respond

The affordability concerns have not been lost on state politicians with many proposing legislation to address these challenges, or pursuing reforms to power markets where pressures have arisen. States in the PJM power capacity market region of the mid-Atlantic have been particularly active with a number proposing legislation for utilities to build regulated generation as a potential solution for the lack of forthcoming new supply. Elsewhere, some states have looked to transfer different cost items from the utility bill to the taxpayer to ease bill pressures, whilst others have focussed on improving the regulatory construct to encourage investment by the utilities (particularly in generation). States more to the west have been no less focussed on affordability but in addition have been dealing with evolving wildfire concerns and looking at ways to limit the risks and liabilities for utilities. Nowhere is this more critical than in California given the impact of the Los Angeles fires in January and the reforms needed for the state’s wildfire fund. The legislative session there runs until September and the topic, along with addressing affordability, are being followed closely by the local utilities and investors.

Subject to each state’s market structure, regulation, energy policies and other characteristics, all are focussed on affordability concerns, to varying degrees. Similarly, all states have an agenda for economic development and different initiatives to attract investment from different sectors. Waiving state taxes for data centres (and for other sectors) has been a common proposal, amongst other initiatives. Utilities have a role to play here as well given the relative appeal of their rates compared to other states and regions. All utility management teams communicated their active engagement with politicians and stakeholders in this regard, and in general, to improve outcomes for their investors and customers.

Transmission could potentially be part of the solution

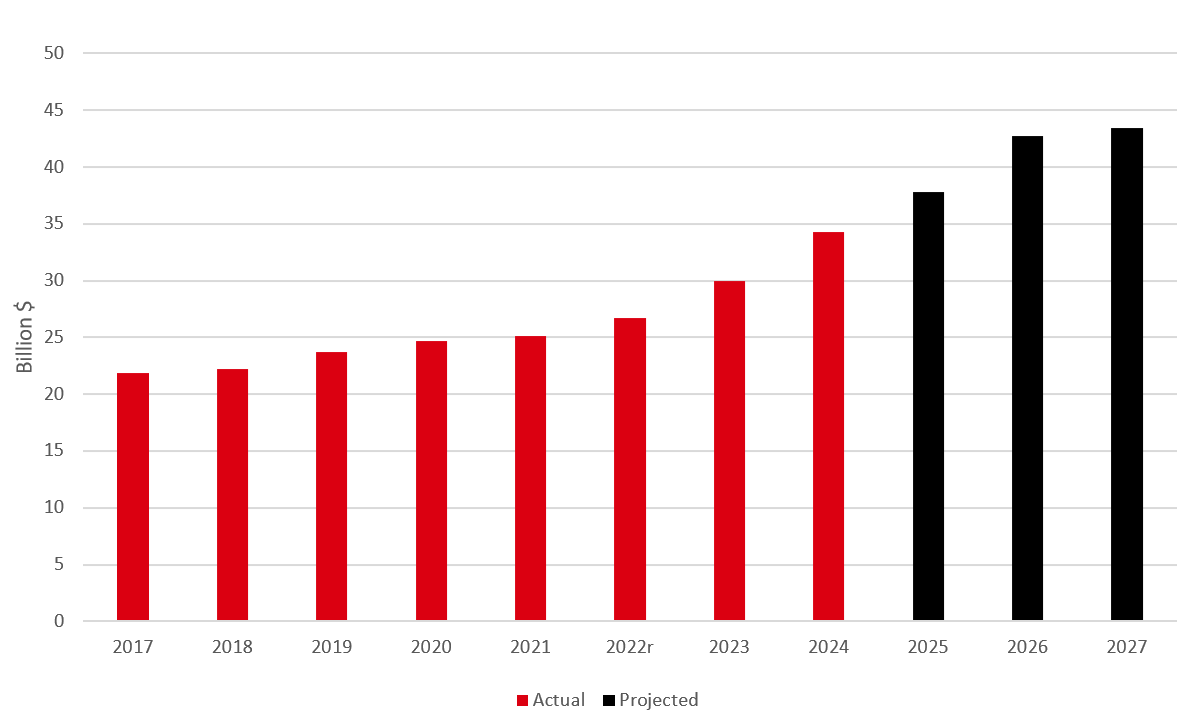

It is generally accepted by most utility industry stakeholders in the US that the investor-owned utilities need to be part of the solution to meeting the growing demand with new supply, ensuring reliability, and keeping bills affordable. Utility investments are a key component of addressing this trilemma and despite the associated cost recovery incurred, should lead to lower bills and/or improved service for customers. For the utilities that we are following in the US, transmission investments are expected to play an increasingly important role in this regard, due to both the under-investment for many years and the criticality of connecting supply and demand. These investments could include connecting new large loads (e.g. data centres) where capacity exists, connecting new supply resources (e.g. renewables) to meet demand or improving flows through de-bottlenecking and enhancing reliability (mitigating outages).

Given their importance to the current challenges in the industry there has been a renewed focus on these investments from most stakeholders. However, separate to most other utility investments, transmission is regulated at a federal level (by Federal Energy Regulatory Commission, or FERC), whilst planning is undertaken at a regional level (by Regional Transmission Operators, or RTO’s), requiring different levels of engagement. Management teams are closely following developments at the FERC with several relevant topics before the Commission and recent Commissioner appointments by the President. Whilst the various RTO’s have developed an almost annual rhythm to allocating projects to the utilities and/or running competitive tenders. Meanwhile the utilities also called out Federal legislation on permitting reform as a further catalyst given the long lead times usually involved with these projects. All are important to what is a potentially high growth segment of the industry.

Chart 4: US investor-owned utility transmission investments (EEI, 2025)

Conclusion

The US utilities sector has seen a busy start to 2025 with no let-up expected for the rest of the year and beyond. State and Federal legislation, Presidential Executive Orders, evolving demand growth (particularly from data centres), affordability and wildfire concerns, have all been topical so far this year and will continue to play out in the months and years ahead. Meanwhile, investment opportunities such as transmission, but also across the industry, continue to evolve favourably. Given the attractive growth at returns that more than compensate for the inherent risk characteristics, we believe it is exciting time to invest in the US utilities sector, and the discussions from these interactions an important input into our investment process. As such, we will continue to closely follow these factors and others for the companies we follow and invest for the benefit of our clients’ investment outcomes.

Meet the Author

|

Joseph TitmusManaging Principal, Listed Infrastructure Equity joseph.titmus@hsbc.com.au |

Key Risks

- Alternatives Risk: There are additional risks associated with specific alternative investments within the portfolios; these investments may be less readily realiable than others and it may therefore be difficult to sell in a timely manner at a reasonable price or to obtain reliable information about their value; there may also be greater potential for significant price movements.

- Equity risk: Portfolios that invest in securities listed on a stock exchange or market could be affected by general changes in the stock market. The value of investments can go down as well as up due to equity markets movements.

- Interest rate risk: As interest rates rise debt securities will fall in value. The value of debt is inversely proportional to interest rate movements.

- Counterparty risk: The possibility that the counterparty to a transaction may be unwilling or unable to meet its obligations.

- Derivatives risk: Derivatives can behave unexpectedly. The pricing and volatility of many derivatives may diverge from strictly reflecting the pricing or volatility of their underlying reference(s), instrument or asset.

- Emerging markets risk: Emerging markets are less established, and often more volatile, than developed markets and involve higher risks, particularly market, liquidity and currency risks.

- Exchange rate risk: Changes in currency exchange rates could reduce or increase investment gains or investment losses, in some cases significantly.

- Investment leverage risk: Investment leverage occurs when the economic exposure is greater than the amount invested, such as when derivatives are used. A Fund that employs leverage may experience greater gains and/or losses due to the amplification effect from a movement in the price of the reference source.

- Liquidity risk: Liquidity risk is the risk that a Fund may encounter difficulties meeting its obligations in respect of financial liabilities that are settled by delivering cash or other financial assets, thereby compromising existing or remaining investors.

- Operational risk: Operational risks may subject the Fund to errors affecting transactions, valuation, accounting, and financial reporting, among other things.

- Style risk: Different investment styles typically go in and out of favour depending on market conditions and investor sentiment.

- Model risk: Model risk occurs when a financial model used in the portfolio management or valuation processes does not perform the tasks or capture the risks it was designed to. It is considered a subset of operational risk, as model risk mostly affects the portfolio that uses the model.

- Sustainability Risk: Sustainability risk means an environmental, social or governance event or condition that, if it occurs, could cause an actual or a potential material negative impact on the value of the investment.

Important information

For Professional Clients and intermediaries within countries and territories set out below; and for Institutional Investors and Financial Advisors in the US. This document should not be distributed to or relied upon by Retail clients/investors.

The value of investments and the income from them can go down as well as up and investors may not get back the amount originally invested. The performance figures contained in this document relate to past performance, which should not be seen as an indication of future returns. Future returns will depend, inter alia, on market conditions, investment manager’s skill, risk level and fees. Where overseas investments are held the rate of currency exchange may cause the value of such investments to go down as well as up. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets. Economies in Emerging Markets generally are heavily dependent upon international trade and, accordingly, have been and may continue to be affected adversely by trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries and territories with which they trade. These economies also have been and may continue to be affected adversely by economic conditions in the countries and territories in which they trade.

The contents of this document may not be reproduced or further distributed to any person or entity, whether in whole or in part, for any purpose. All non-authorised reproduction or use of this document will be the responsibility of the user and may lead to legal proceedings. The material contained in this document is for general information purposes only and does not constitute advice or a recommendation to buy or sell investments. Some of the statements contained in this document may be considered forward looking statements which provide current expectations or forecasts of future events. Such forward looking statements are not guarantees of future performance or events and involve risks and uncertainties. Actual results may differ materially from those described in such forward-looking statements as a result of various factors. We do not undertake any obligation to update the forward-looking statements contained herein, or to update the reasons why actual results could differ from those projected in the forward-looking statements. This document has no contractual value and is not by any means intended as a solicitation, nor a recommendation for the purchase or sale of any financial instrument in any jurisdiction in which such an offer is not lawful. The views and opinions expressed herein are those of HSBC Asset Management at the time of preparation, and are subject to change at any time. These views may not necessarily indicate current portfolios' composition. Individual portfolios managed by HSBC Asset Management primarily reflect individual clients' objectives, risk preferences, time horizon, and market liquidity. Foreign and emerging markets. Investments in foreign markets involve risks such as currency rate fluctuations, potential differences in accounting and taxation policies, as well as possible political, economic, and market risks. These risks are heightened for investments in emerging markets which are also subject to greater illiquidity and volatility than developed foreign markets. This commentary is for information purposes only. It is a marketing communication and does not constitute investment advice or a recommendation to any reader of this content to buy or sell investments nor should it be regarded as investment research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of its dissemination. This document is not contractually binding nor are we required to provide this to you by any legislative provision.

All data from HSBC Asset Management unless otherwise specified. Any third party information has been obtained from sources we believe to be reliable, but which we have not independently verified.

HSBC Asset Management is the brand name for the asset management business of HSBC Group, which includes the investment activities that may be provided through our local regulated entities. HSBC Asset Management is a group of companies in many countries and territories throughout the world that are engaged in investment advisory and fund management activities, which are ultimately owned by HSBC Holdings Plc. (HSBC Group). The above communication is distributed by the following entities:

- In Australia, this document is issued by HSBC Bank Australia Limited ABN 48 006 434 162, AFSL 232595, for HSBC Global Asset Management (Hong Kong) Limited ARBN 132 834 149 and HSBC Global Asset Management (UK) Limited ARBN 633 929 718. This document is for institutional investors only, and is not available for distribution to retail clients (as defined under the Corporations Act). HSBC Global Asset Management (Hong Kong) Limited and HSBC Global Asset Management (UK) Limited are exempt from the requirement to hold an Australian financial services license under the Corporations Act in respect of the financial services they provide. HSBC Global Asset Management (Hong Kong) Limited is regulated by the Securities and Futures Commission of Hong Kong under the Hong Kong laws, which differ from Australian laws. HSBC Global Asset Management (UK) Limited is regulated by the Financial Conduct Authority of the United Kingdom and, for the avoidance of doubt, includes the Financial Services Authority of the United Kingdom as it was previously known before 1 April 2013, under the laws of the United Kingdom, which differ from Australian laws;

- in Bermuda by HSBC Global Asset Management (Bermuda) Limited, of 37 Front Street, Hamilton, Bermuda which is licensed to conduct investment business by the Bermuda Monetary Authority;

- in Chile: Operations by HSBC's headquarters or other offices of this bank located abroad are not subject to Chilean inspections or regulations and are not covered by warranty of the Chilean state. Obtain information about the state guarantee to deposits at your bank or on www.cmfchile.cl;

- in Colombia: HSBC Bank USA NA has an authorized representative by the Superintendencia Financiera de Colombia (SFC) whereby its activities conform to the General Legal Financial System. SFC has not reviewed the information provided to the investor. This document is for the exclusive use of institutional investors in Colombia and is not for public distribution;

- in France, Belgium, Netherlands, Luxembourg, Portugal, Greece, Finland, Norway, Denmark and Sweden by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026);

- in Germany by HSBC Global Asset Management (Deutschland) GmbH which is regulated by BaFin (German clients) respective by the Austrian Financial Market Supervision FMA (Austrian clients);

- in Hong Kong by HSBC Global Asset Management (Hong Kong) Limited, which is regulated by the Securities and Futures Commission. This video/content has not be reviewed by the Securities and Futures Commission;

- in India by HSBC Asset Management (India) Pvt Ltd. which is regulated by the Securities and Exchange Board of India;

- in Italy and Spain by HSBC Global Asset Management (France), a Portfolio Management Company authorised by the French regulatory authority AMF (no. GP99026) and through the Italian and Spanish branches of HSBC Global Asset Management (France), regulated respectively by Banca d’Italia and Commissione Nazionale per le Società e la Borsa (Consob) in Italy, and the Comisión Nacional del Mercado de Valores (CNMV) in Spain;

- in Malta by HSBC Global Asset Management (Malta) Limited which is regulated and licensed to conduct Investment Services by the Malta Financial Services Authority under the Investment Services Act;

- in Mexico by HSBC Global Asset Management (Mexico), SA de CV, Sociedad Operadora de Fondos de Inversión, Grupo Financiero HSBC which is regulated by Comisión Nacional Bancaria y de Valores;

- in the United Arab Emirates, Qatar, Bahrain & Kuwait by HSBC Global Asset Management MENA, a unit within HSBC Bank Middle East Limited, U.A.E Branch, PO Box 66 Dubai, UAE, regulated by the Central Bank of the U.A.E. and the Securities and Commodities Authority in the UAE under SCA license number 602004 for the purpose of this promotion and lead regulated by the Dubai Financial Services Authority. HSBC Bank Middle East Limited is a member of the HSBC Group and HSBC Global Asset Management MENA are marketing the relevant product only in a sub-distributing capacity on a principal-to-principal basis. HSBC Global Asset Management MENA may not be licensed under the laws of the recipient’s country of residence and therefore may not be subject to supervision of the local regulator in the recipient’s country of residence. One of more of the products and services of the manufacturer may not have been approved by or registered with the local regulator and the assets may be booked outside of the recipient’s country of residence.

- in Peru: HSBC Bank USA NA has an authorized representative by the Superintendencia de Banca y Seguros in Perú whereby its activities conform to the General Legal Financial System - Law No. 26702. Funds have not been registered before the Superintendencia del Mercado de Valores (SMV) and are being placed by means of a private offer. SMV has not reviewed the information provided to the investor. This document is for the exclusive use of institutional investors in Perú and is not for public distribution;

- in Singapore by HSBC Global Asset Management (Singapore) Limited, which is regulated by the Monetary Authority of Singapore. The content in the document/video has not been reviewed by the Monetary Authority of Singapore;

- In Switzerland by HSBC Global Asset Management (Switzerland) AG. This document is intended for professional investor use only. For opting in and opting out according to FinSA, please refer to our website; if you wish to change your client categorization, please inform us. HSBC Global Asset Management (Switzerland) AG having its registered office at Gartenstrasse 26, PO Box, CH-8002 Zurich has a licence as an asset manager of collective investment schemes and as a representative of foreign collective investment schemes. Disputes regarding legal claims between the Client and HSBC Global Asset Management (Switzerland) AG can be settled by an ombudsman in mediation proceedings. HSBC Global Asset Management (Switzerland) AG is affiliated to the ombudsman FINOS having its registered address at Talstrasse 20, 8001 Zurich. There are general risks associated with financial instruments, please refer to the Swiss Banking Association (“SBA”) Brochure “Risks Involved in Trading in Financial Instruments;

- in Taiwan by HSBC Global Asset Management (Taiwan) Limited which is regulated by the Financial Supervisory Commission R.O.C. (Taiwan);

- in Turkiye by HSBC Asset Management A.S. Turkiye (AMTU) which is regulated by Capital Markets Board of Turkiye. Any information here is not intended to distribute in any jurisdiction where AMTU does not have a right to. Any views here should not be perceived as investment advice, product/service offer and/or promise of income. Information given here might not be suitable for all investors and investors should be giving their own independent decisions. The investment information, comments and advice given herein are not part of investment advice activity. Investment advice services are provided by authorized institutions to persons and entities privately by considering their risk and return preferences, whereas the comments and advice included herein are of a general nature. Therefore, they may not fit your financial situation and risk and return preferences. For this reason, making an investment decision only by relying on the information given herein may not give rise to results that fit your expectations.

- in the UK by HSBC Global Asset Management (UK) Limited, which is authorised and regulated by the Financial Conduct Authority;

- and in the US by HSBC Global Asset Management (USA) Inc. which is an investment adviser registered with the US Securities and Exchange Commission.

- In Uruguay, operations by HSBC's headquarters or other offices of this bank located abroad are not subject to Uruguayan inspections or regulations and are not covered by warranty of the Uruguayan state. Further information may be obtained about the state guarantee to deposits at your bank or on www.bcu.gub.uy.

Copyright © HSBC Global Asset Management Limited 2025. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of HSBC Global Asset Management Limited.

Content ID: D049357_v2.0; Expiry Date: 31.07.2026